Term Deposit frequently asked questions

Q: Why are Judo Bank's award-winning Personal, Business and SMSF Term Deposits offered online only?

Because we’re a digital bank without branches.

We have a secure and user-friendly application process and offer simple digital account management (via our mobile app or Digital Banking platform) allowing you to easily manage your term deposit.

Q: What is the minimum and maximum amount I can deposit into an online Judo Bank Term Deposit?

The minimum deposit amount is $1,000. The maximum you can open your account with online is $2 million. Give us a call on 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) if you’d like to open a Term Deposit for more than that and we can see if we can help.

Q: Where can I view Judo Bank’s Term Deposit terms and conditions?

Judo Bank’s terms and conditions (T&Cs) can be accessed on our website at Term Deposit Terms and Conditions.

Q: What do I need to apply for an online Personal Term Deposit?

To apply, you’ll need:

- a minimum of two identification documents – you can use your current Australian Driver’s Licence, Passport and/or Medicare Card for identification purposes;

- an Australian Bank Account with another financial institution – this needs to be in your name (or names if this is a joint application) as it will be used to pay funds into (such as interest you earn);

- your Australian Tax File Number (TFN) or exemption code - collection of TFNs is authorised by law. It’s not compulsory to quote a TFN, however, if you choose not to, we’ll need to deduct withholding tax from any interest we pay you at the highest marginal tax rate (plus applicable Commonwealth tax levies); and

- a mobile number and email address for verification and correspondence purposes. Keep in mind that for joint applications, each applicant will require their own unique email address and mobile phone number.

Term Deposits can only be opened by the account applicant themselves. The person applying for the account must be:

- over 18 years of age;

- an Australian resident for tax purposes; and

- living at an Australian residential address.

Q: What do I do if I am having issues with my Term Deposit application?

If you’re having trouble with your online application, please go to our “contact” page on our website or call us on 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays).

Q: How do I know if my identity has been verified?

If your identity has been verified successfully, you will be able to proceed with submitting your application (or your part of an application where it is a joint, SMSF or Business application) as your verification will have been completed.

If your identity cannot be satisfactorily verified during the application process, a prompt will appear on-screen.

If this happens, you will be able to review and update your information and attempt the verification process again. If you have still not been able to proceed past the verification stage, please contact us on 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) as we may be able to help.

Please note that Judo Bank cannot open a Term Deposit account for you, or accept any deposit from you, until all required identity verifications have been successfully completed. We are unable to complete this step over the phone on your behalf.

Q: Why can't I verify my identity?

There are a number of reasons why you might not be able to satisfactorily pass the identity verification process. These usually relate to the information you have provided, or differences between the information you have provided and the electronic sources that are used to verify your identity. Make sure that:

- the name you have used to apply exactly matches your identification

- you are correctly replicating the details on your identity documentation

- your documentation is current and meets Judo Bank’s criteria

- you enter data for all three recommended types of identification, if possible.

Q: What do I need to make a joint application?

The application process for joint account holders (ie an application for yourself and another person) mirrors that of a single account holder. The first applicant must complete the application and have the permission of the second party to add them to the application as part of the journey (the first applicant will need the name and unique email address of the second applicant). Upon the first applicant submitting the application, the second applicant will receive an email from Judo Bank asking for them to complete their part of the application. They must follow the prompts to complete their application for this joint account.

Keep in mind, if you're applying for a joint online Term Deposit account, you must provide a unique email address and mobile number for each applicant. Both email addresses and both mobile phone numbers will be verified. We cannot open a Term Deposit for you, or accept any deposit from you, until we have satisfactorily verified the identities of all account holders.

Q: Does the Financial Claims Scheme cover Term Deposits?

Yes, Term Deposits with Judo Bank are covered up to a limit of $250,000 for each account holder under the Government's Financial Claims Scheme (FCS). You can find out more about the FCS at www.fcs.gov.au.

Q: How do I set up a nominated bank account?

During the application process, you will be asked for the details of your nominated bank account – this is your external bank account with an Australian authorised deposit-taking institution, which we’ll use to transfer out any funds on maturity, or as you instruct.

If you already have a Judo Bank online Term Deposit and wish to change your nominated bank account for it, just log in to Digital Banking, go to Payees>Add Nominated Account>Add. For your protection, we’ll need to verify that you’ve made this change, so we’ll send a multi-factor authentication request to your mobile phone that you’ll need to enter to complete the change. You can find step-by-step instructions on how to set up a nominated bank account here: www.judo.bank/help-hub/nominated-account-update.

Q: Does Judo Bank charge any fees on its Term Deposits?

Judo Bank does not charge any application or monthly account fees or charges on our Term Deposit product. Keep in mind, however, that if you wish to withdraw money from your Term Deposit before the agreed Maturity Date, you may incur a prepayment adjustment (which takes the form of an amount equivalent to a reduced rate of interest that will be applied to the amount withdrawn). Please see www.judo.bank/term-deposit-accounts-terms-and-conditions for more information.

Q: Can I apply for an online Term Deposit if I have power of attorney?

All Term Deposits must be opened by the account applicant(s) themselves. However, if you have successfully opened a Term Deposit and later require a power of attorney to operate your account, please call us on 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) to discuss how we can help.

Q: I want to continue my application - how can I do that?

You will have received an email from Judo Bank letting you know that your application has been saved, so just follow the steps described in this email to continue your saved application. Remember, you need to complete your application to be able to submit it.

Q: Why do I need to provide an email address?

You need an email address to be able to apply for, and manage, your online Term Deposit. We’ll use your email address to communicate with you, for instance, letting you know when your Term Deposit is nearing maturity. You’ll also need it for some activities you may wish to undertake as part of Digital Banking.

Q: I need more information about Judo Bank’s online Term Deposit product

If you require any further information about our Term Deposit product, take a look at our Term Deposit Help Hub, Terms and Conditions, Privacy Policy and these FAQs for more information. If you still need help, please call 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) or email us using customers@judo.bank.

Q: How much time do I have to fund my online Judo Bank Term Deposit and is there a minimum amount?

You have 10 calendar days from the date your account is opened to transfer funds into your new online Term Deposit.

The current minimum deposit amount is $1,000. If no funds, or less than the minimum amount, are deposited into your account during the funding period, we may close your account and return your funds to your Nominated Account, and any such funds will not accrue interest.

Q: How do I deposit money into my online Term Deposit account?

There are two ways you can fund your Judo Bank account:

- Perform a ‘Pay Anyone’ via your bank account to Judo Bank, using BSB 725-888 and your Judo Bank account number. Please keep in my mind that ‘Pay Anyone’ transfers take 1-2 business days to be available in your Term Deposit; or

- Perform a BPAY to Judo Bank using Biller Code 274753, and your Judo Bank account number as the Biller Reference Code. You can transfer up to $500,000 per day via BPAY, subject to the daily BPAY limit on the account you are transferring from. Please keep in my mind that ‘BPAY’ transactions take 3-5 business days to be available in your Term Deposit.

Q: How long does it take for a payment or transfer to reach another bank?

It will depend on the timing of the outbound payment. Transfers completed on business days before 4pm Australian Eastern Standard Time (or Australian Eastern Daylight Time when relevant) are usually processed overnight. In this case, funds are generally available in your external nominated bank account the next business day. Funds sent after 4pm Australian Eastern Standard Time (or Australian Eastern Daylight Time, when relevant) will generally be available in your account within 2 business days.

Q: Can I transfer funds via BPAY?

Yes, you can perform a BPAY to Judo Bank using Biller Code 274753 with your Judo Bank account number as the Biller Reference Code. You can transfer up to $500,000 per day via BPAY, subject to the daily BPAY limit for the account you are transferring from.

Q: What if I have only partially funded my account?

You can continue to deposit funds into your account for the first 10 days of the account opening. On the 10th calendar day your account will locked for the duration of the term, provided the balance in the account is at least the Minimum Amount.

Q: Can I add more money to my Judo Bank Term Deposit?

You cannot add more funds to your account once your Term Deposit has been fixed. If you attempt to make further deposits after this time, these payments will not be processed and funds will be returned to where they came from.

Although you cannot transfer funds into an existing Term Deposit during its term, you can always open a new Term Deposit account (as long as the deposit is at least the minimum amount of $1,000).

Q: How can I transfer a large amount from my external bank to a Judo Bank account?

You’ll need to contact your other bank to understand their transfer and withdrawal limits (these are the limits that restrict the amount of money you can transfer between accounts on any given day). Keep in mind that you only have 10 calendar days from the date your account is opened to transfer funds into your new Judo Bank online Term Deposit.

Q: How does Judo Bank calculate interest?

Simple interest begins to accrue on the day the opening deposit is made to your account. Interest is calculated daily on each daily closing balance (i.e. your principal invested) during the term (excluding the date of withdrawal, maturity or next interest payment), by using the Interest Rate that applied on the day we opened your account (or the date your account is renewed/rolled over) to the daily closing balance. The following formula is used: ‘Daily closing balance x (applicable Interest Rate/365)’ where the daily closing balance is equivalent to the principal you invested. The applicable Interest Rate that applies to your account is fixed.

Q: Where can I view the interest rate applicable to my online Judo Bank Term Deposit?

The interest rate applicable to your online Term Deposit account can be found by logging into Digital Banking. You’ll find details of your interest rate under your account details. You’ll also be able to see the interest rate on your statement or your welcome email, which you can access via Digital Banking.

Q: Will my interest rate change?

Your interest rate is fixed for the term of your Term Deposit (unless you seek to break your Term Deposit before maturity). At the end of term, if you decide to rollover your funds, your interest rate will be the Term Deposit Interest Rate applicable at the time your account balance is reinvested plus the loyalty bonus, if applicable. Please be aware that the new Term Deposit may have a higher or lower interest rate.

Q: Where can I find how much interest I earned for the previous financial year for my online Term Deposit?

You can view interest earned in the previous financial year by logging in to your Digital Banking profile and navigating to the appropriate account>Account Info summary>Interest earned in last tax year.

Q: Can I change my maturity instructions via Digital Banking?

To change what happens when your Term Deposit matures (i.e. to change your maturity instructions), log in to Digital Banking and click on the online Term Deposit account you wish to amend and then into the Details for this account. You’ll then see the option to edit your maturity instructions. Your current maturity instructions are shown, and you can use Digital Banking to change them, subject to the process and applicable cut-off times set out in the terms and conditions for the Digital Banking Services.

You have three options to choose from at maturity (noting that not all maturity options may be available for the interest payment frequency that you have selected, which you will see when you apply):

- rollover principal and interest – this will see you reinvest the entire account balance into a new Term Deposit; or

- rollover principal – this will see you reinvest the principal amount (excluding any accrued interest) into a new Term Deposit and any accrued interest will be paid into your Nominated Account; or

- pay out and close – this will pay out the entire account balance into your Nominated Account and your Term Deposit will then be closed.

If you do not see these maturity options, or you have not selected a maturity option, option “a” above is the default option and you agree that this is the option.

Once you have chosen your maturity instructions, simply click on the ‘Modify maturity instructions’ button and your changes will be saved.

For rollover options (options a and b mentioned above), you can choose to amend the term you are reinvesting for. You’ll be able to select from 3-month to 5-year terms. Keep in mind the applicable interest rate will be the prevailing interest rate on the maturity date, which may be a lower interest rate than that applicable to your previous term deposit.

If you choose to roll over your Term Deposit, you will also have the option of adding additional funds to the Term Deposit once your Term Deposit reaches maturity. You can deposit additional funds using your existing Term Deposit BSB and account number into your account up to 10 calendar days after your Term Deposit has rolled over.

You can also change your maturity instructions outside Digital Banking by contacting us before the daily cut-off time of 1 pm Melbourne time on 13 JUDO (13 58 36) during Business Hours on or before the Business Day before the Maturity Date (e.g., if the Maturity Date is a Monday that is a Business Day, you can change your maturity instructions up until 1 pm on the Friday before, where the Friday is a Business Day).

Q: How do I top up my Term Deposit at maturity?

If you choose to roll over your Term Deposit, you will also have the option of adding additional funds to the Term Deposit once your Term Deposit reaches maturity. You can deposit additional funds using your existing Term Deposit BSB and account number into your account up to 10 calendar days after your Term Deposit has rolled over.

Q: How will I know when my online Judo Bank Term Deposit is maturing?

All information about your Term Deposit account, including opening date and your maturity date, can be found by logging into Digital Banking. We will also send you reminders via email before your Term Deposit matures so look out for these in your email inbox.

Q: How do I qualify for the Personal Term Deposit Loyalty Bonus?

We may offer you a bonus interest rate (which we call a Loyalty Bonus) if you reinvest the principal of your Personal Term Deposit at the Maturity Date into another Term Deposit. The Loyalty Bonus will apply to the new term and will be added to the standard Term Deposit Interest Rate applicable at the time your Account balance is reinvested (provided you do not withdraw any part during the applicable Grace Period). You will not be eligible for the Loyalty Bonus if you withdraw any part of the funds in your Account before the Maturity Date of your new Term Deposit (which includes during the Grace Period). Loyalty Bonuses are not transferable and are not cumulative (e.g. if you received a 0.05% Loyalty Bonus on a recent Term Deposit and are now receiving a Loyalty Bonus of 0.05% on your rolled over Term Deposit, the Loyalty Bonus is 0.05%).

Q: What are my options at maturity for my online Term Deposit?

You have three options to choose from at maturity (noting that not all maturity options may be available for the interest payment frequency that you have selected, which you will see when you apply):

- rollover principal and interest – this will see you reinvest the entire account balance into a new Term Deposit; or

- rollover principal – this will see you reinvest the principal amount (excluding any accrued interest) into a new Term Deposit and any accrued interest will be paid into your Nominated Account; or

- pay out and close – this will pay out the entire Account balance into your Nominated Account and your Term Deposit will then be closed.

If you do not see these maturity options, or you have not selected a maturity option, option “a” above is the default option and you agree that this is the option.

Q: What are Judo Bank's opening hours?

Judo Bank Digital Banking services are generally available 24/7 as long as you have Digital Banking access. You can send us a secure message via Digital Banking or give us a call on 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays).

Q: How can I make a complaint?

We know we sometimes get things wrong, so if that happens, we’d really like to know so that we can aim to put things right and make improvements. You can provide feedback by:

- Visiting our website and completing the online form on our ‘contact’ page – just select ‘complaints’ and give us as much information as you can about what’s gone wrong; or

- Email us at customers@judo.bank so we can try to work through the issues you’ve experienced; or

- Call us on 13 JUDO (13 5836). We’re here to help from Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays)

When we receive your complaint, we’ll acknowledge your complaint and investigate it as soon as we can. If you are not satisfied with how a complaint has been handled, you can lodge a complaint directly with:

AFCA contact details: www.afca.org.au

Email: info@afca.org.au

Phone: 1800 931 678 (free call)

Mail: Australian Financial Complaints Authority, GPO Box 3, MELBOURNE VIC 3001

Time limits to make a complaint to AFCA apply.

Q: What is withholding tax and when is it deducted?

Withholding tax is deducted from the gross amount of interest paid to you. The money we withhold is paid to the Australian Taxation Office and you may be able to claim a credit for this amount when you lodge your tax return.

Withholding tax may apply to interest paid on your account where you have not provided a valid Tax File Number (TFN) or TFN exemption. For joint accounts, all customers must provide a TFN or exemption code to avoid withholding tax deductions.

The collection of a valid Tax File Number (TFN) is authorised by law. It’s not compulsory to quote a TFN, however, if you choose not to, we’ll need to deduct withholding tax at the highest marginal tax rate (plus applicable Commonwealth tax levies) from any interest you earn.

Q: What kind of access do authorised representatives have?

Authorised representatives have full authority on any account(s) that they are appointed on and will also receive all notices in relation to that account unless we agree otherwise. Authorised representatives are jointly responsible for the account with the account holder(s) and for any obligation of the account holder(s).

Q: Who can access and manage my account?

Only an account holder can access an account, unless we otherwise agree that another person can access an account, and such person is appropriately verified.

Q: What do I do if I can't log in?

If the login box does not display, please refresh the page or change browsers. Double-check that the login email address and password that you've entered are correct and match those that you used to register your account. If you cannot remember your password, click the "Digital Banking" button at the top of the Judo Bank webpage and then click >”I’ve forgotten my password”. Follow the prompts to reset your password.

Q: Does Judo Bank accept or issue cheques?

No, Judo Bank does not accept or issue bank cheques.

Q: Can I access my Judo Bank account when I am overseas?

You can access our Digital Banking platform from overseas provided you have internet access and use the mobile number, PIN and/or biometric access method you registered with to log in. If you’d prefer to use our web-based platform, just log in via our website using the Digital Banking button and your existing login credentials remembering to keep your details secure.

Q: Why do I need to provide my Taxpayer Identification Number (TIN) when completing my Judo Bank Term Deposit application?

The Australian Government has enacted laws that require financial institutions to identify and report on accounts held by customers who are foreign tax residents. This obligation requires Judo Bank to collect self-certifications from customers declaring their tax residency and providing their foreign tax details (including their TIN if applicable) at the time of opening an account. This information will be reported to the Australian Taxation Office (ATO) and potentially shared with other international tax authorities. If you require further background, the ATO has published guidance for customers on these requirements here.

Q: How do I change my address or other personal details?

To update your personal details, log in to Digital Banking then select Personal Details. You can update details such as your home and work phone number and address.

Q: How do I change my contact email address via Digital Banking?

To update your email address that we use to correspond with you, just log in to Digital Banking and select Personal Details>Email Address>Change. Your username (that you use to log in to Digital Banking) and your email address, that we use to contact you, do not need to match. However, it’s really important that we have the right email address listed on your account as we use this to send important information to you.

Q: How do I provide my Tax File Number (TFN) or exemption code for my Term Deposit via Digital Banking?

You can provide your TFN or exemption code by logging in to Digital Banking – go to Personal Details>Tax File Number>Change which will allow you to add your TFN. If you have already added your TFN, you will not be able to change this again via Digital Banking, so please call us on 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) to discuss how we can help.

Keep in mind, collection of TFNs is authorised by law. It’s not compulsory to quote a TFN, however, if you choose not to, we’ll need to deduct withholding tax from any interest we pay you, at the highest marginal tax rate (plus applicable Commonwealth tax levies).

Q: How do I make a hardship request?

To make a hardship request, please contact us on 13 JUDO (13 58 36) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) or email us at customers@judo.bank. We’ll need to ask you a number of questions to understand your situation and to be able to see how we might be able to help. We can then review your request and contact you with an outcome.

Q: Can I have a copy of my End of Financial Year statements for previous years?

You can access your end of year financial statements via Digital Banking if you have an online Term Deposit. You’ll see these listed under your profile on the mobile app and on the left-hand navigation on our Digital Banking platform, which you can access via our website.

Q: My statement is incorrect, what do I do?

If you suspect there’s an error on your statement, please email us at customers@judo.bank or call us on 13 JUDO (13 58 36) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays). We will review the statement and contact you with an update.

Q: Can I withdraw my online Term Deposit early?

When you invest in a Term Deposit, you are investing a fixed amount, for a defined term at a fixed rate. If you wish to withdraw money from your Term Deposit before the agreed Maturity Date you will need to submit a valid request so please contact us by calling 13 JUDO (13 58 36) to commence an early withdrawal request.

You must give us no less than 31 calendar days’ notice before you need the funds (the notice period commences on the Business Day we receive your valid request), unless proven financial hardship applies. However, if your Term Deposit has less than 31 calendar days remaining until its maturity date, the earliest you may access the funds is at the maturity date, unless financial hardship applies.

We are entitled to make a Prepayment Adjustment to any early withdrawal before the Maturity Date, which take the form of an amount equivalent to a reduced rate of interest that will be applied to the funds withdrawn. (See www.judo.bank/term-deposit-accounts-terms-and-conditions for further information).

If we allow you to break a Term Deposit prior to the maturity date, we will transfer the entire balance, less any outstanding fees, taxes, charges and the Prepayment Adjustment we are entitled to charge, electronically to your Nominated Account on the next applicable Business Day following the end of the 31-calendar day Notice Period (or earlier if financial hardship applies).

Funds can only be transferred to a verified nominated bank account. To ensure you have set up a nominated account for your Term Deposit, log in to Digital Banking then go to Payees>Add Nominated Account>Add. To finalise this change, we will need to verify that the change is being made by you by sending a verification code to your mobile phone. Please enter the code and click ‘Complete’. You can find step by step instructions on how to set up a nominated bank account here: www.judo.bank/help-hub/nominated-account-update

An early withdrawal request will be taken to relate to your entire Term Deposit balance, unless we agree otherwise, acting reasonably, and your account will be closed in accordance with the Terms and Conditions. If a partial early withdrawal is permitted (and only one partial withdrawal is permitted during the term), you must maintain a minimum balance of $1,000, unless we otherwise agree, or your account may be closed in accordance with the Terms and Conditions.

Important notice: While we have the discretion to deduct the Prepayment Adjustment from the principal or the interest of your Term Deposit payable at the termination date, we will generally deduct any Prepayment Adjustment from the interest payable at the termination date, or principal if interest has already been paid. We recommend you seek professional tax advice about the applicable Australian tax consequences to you of seeking an early withdrawal from a Term Deposit and the tax treatment of any Prepayment Adjustment.

Q: What is a Term Deposit break cost (also known as a "Prepayment Adjustment")?

When you invest in a Term Deposit, you are investing a fixed amount, for a defined term at a fixed rate. If you wish to withdraw money from your Term Deposit before the agreed Maturity Date you will need to submit a valid request so please contact us by calling 13 JUDO (13 58 36) to commence an early withdrawal request.

You must give us no less than 31 calendar days’ notice before you need the funds (the notice period commences on the Business Day we receive your valid request), unless proven financial hardship applies. However, if your Term Deposit has less than 31 calendar days remaining until its maturity date, the earliest you may access the funds is at the maturity date, unless financial hardship applies.

We are entitled to make a Prepayment Adjustment to any early withdrawal before the Maturity Date, which takes the form of an amount equivalent to a reduced rate of interest that will be applied to the funds withdrawn. (See www.judo.bank/term-deposit-accounts-terms-and-conditions for further information).

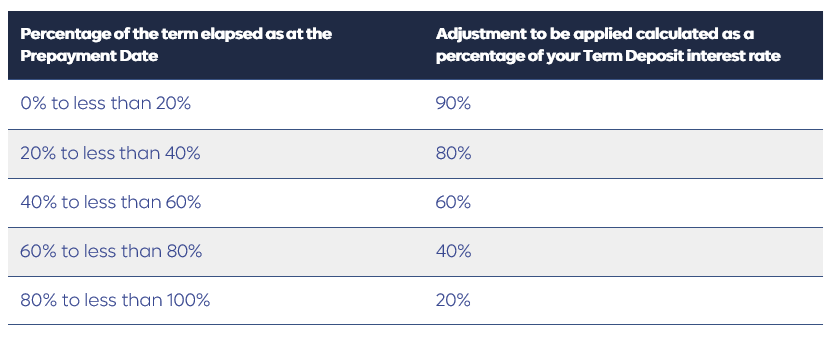

The Prepayment Adjustment may be deducted from the principal or the interest of your Term Deposit payable at the termination date and will depend on the percentage of your original term that has elapsed, as described in the table below:

The closer the Prepayment Date is to the Maturity Date, the lower the Prepayment Adjustment will be.

The Prepayment Adjustment is calculated on the balance current as at the Prepayment date and will apply even if no interest has yet been paid on the Term Deposit up to the Prepayment Date.

For the avoidance of doubt, we take into account interest already paid to you during the term as well as the interest that would have been paid for the entire term. We will not ask you to repay any interest we’ve already paid to you, we will simply deduct the total Prepayment Adjustment amount from the interest payable at the termination date or principal if interest has already been paid.

Where your Term Deposit is only partially withdrawn, the remaining balance will continue to earn your originally agreed Interest Rate (and you may lose any loyalty bonus interest, if applicable to your Term Deposit). If you would like further information about the Prepayment Adjustment you can contact us on 13 JUDO (13 58 36).

We recommend you seek professional tax advice about the applicable Australian tax consequences to you of seeking an early withdrawal from a Term Deposit and the tax treatment of any Prepayment Adjustment.

Q: Is my money safe?

The money you invest with Judo Bank in an online Term Deposit is covered up to a limit of $250,000 for each account holder under the Government’s Financial Claims Scheme (FCS). You can find out more about the Financial Claims Scheme at www.fcs.gov.au. Please take note of the following steps to seek to ensure that you are depositing moneys into a legitimate Judo Bank account.

Q: Where can I learn about security and privacy at Judo Bank?

Judo Bank is committed to protecting your security and privacy online. To learn more about our security standards and procedures visit www.judo.bank/privacy-policy.

Q: What should I do if I receive a suspicious message or call?

If you’re unsure of whether an email or SMS is legitimate and from Judo Bank, it’s better to be cautious:

- Never respond to a suspected scam in any way

- Never allow a caller to remotely access your device. Judo will never ask this of you

- Never read out any SMS or email verification codes to a caller. Judo will never ask this of you

- Don’t open any attachments or links if you are unsure whether they come from Judo. A genuine Judo email should have an @judo.bank or @judocapital.com.au suffix

- Report the message to fraud@judo.bank or call us on 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays).

Remember, Judo Bank will never send you an email or SMS asking for your personal information such as your account details or password.

If you receive a suspicious call asking you to provide or verify personal or financial information, you should hang up and call Judo Bank’s official phone number, 13 58 36 Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays), to verify the communication.

We’re here to support you. Even if you’re unsure – notify us. Any information we get helps us continue to protect you from scams. You can find all our official contact details on the official Judo Bank website www.judo.bank. If any email or SMS you receive does not match the details on our website, please let us know.

You should also report scam attempts to Scamwatch: https://www.scamwatch.gov.au/report-a-scam

Q: How do I know what is legitimate and what is a scam?

The official Judo Bank website at www.judo.bank is the only legitimate Judo Bank website. You cannot apply for a Judo Bank Term Deposit online via any other method or webpage.

Q: What if I sent/deposited money some other way?

If you didn’t go through the www.judo.bank website, get in touch with us immediately at 13 JUDO (13 58 36) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) or at fraud@judo.bank.

You should also notify:

- any other bank involved – e.g. where you transferred money from to the scammers

- Scamwatch https://www.scamwatch.gov.au/report-a-scam

- ACSC https://www.cyber.gov.au/acsc/report

Q: What is Judo Bank doing about scams?

We have a range of processes to help stop attempted scams, including around-the-clock scanning of the Internet for suspicious clones of Judo Bank sites, initiating takedown orders against malicious domains trying to pose as Judo Bank, and continuous monitoring of our website and emails to identify any attempts to compromise them.

While Judo Bank seeks to ensure our systems are kept secure, one thing we have no control over is scammers who might try to imitate us to directly target customers or members of the public. You may have seen this sort of con in other places – maybe a dodgy online vendor offering a ‘genuine Rolex’ at a bargain price. Similarly, scammers can imitate Judo Bank to try and scam you. In all these cases, because the communication is direct from scammer to you, we will not know we have been impersonated until you tell us. So please let us know if you receive any suspicious contact claiming to be from us by calling 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) or emailing us at fraud@judo.bank.

Q: For multi-holder accounts, how many account holders are required to authorise account actions?

Unless we are advised otherwise, all account holders on a multi-holder account have the same authority to provide instructions relating to it. If one account holder provides instructions to us, those instructions are deemed to have been given on behalf of all account holders of the multi-holder account. All communications, including notices, given to one account holder will be deemed to have been given to all of the account holders of a multi-holder account who are all jointly and severally liable and jointly and severally responsible for the multi-holder account. Each account holder has the right to all funds in the multi-holder account. If we are made aware of any dispute on a multi-holder account by an account holder, we may require all of the account holders to provide us with a written authority to any subsequent operation or transaction on the account, or we may, at our discretion, block access to or suspend the account until the dispute is resolved.

No Question's Found!

Business Term Deposit frequently asked questions

Q: What types of Business structures can apply online for a Judo Bank Business Term Deposit?

The following business types are eligible for our online Business Term Deposit product:

Private companies (i.e. Pty Ltd companies) that have

- An ABN

- A maximum number of 9 directors

- Shareholder(s) that are individuals

- Australian tax resident directors and shareholders (we cannot accept applications where directors and shareholders are foreign tax residents) and the company must also be Australian tax resident

Trusts with a corporate trustee or up to six individual trustee(s) that have

- An ABN

- A maximum number of 6 individual trustees or one corporate trustee

- A certified copy of the trust deed and any amendments

- Australian tax resident individual trustees (we cannot accept application from foreign tax residents)

Registered Incorporated Associations that have

- An ABN and an incorporation registration number

- The ability to provide details for their Chairman, Secretary and Treasurer to allow verification of their identity

- A certificate of incorporation provided by the relevant state or territory regulator

Q: What do I need to provide to complete the online application?

All Related Persons associated with the business (eg director, trustee or officeholder) will need to provide:

- A minimum of two identification documents – you can use your current Australian driver’s licence, passport or Medicare card for identification purposes.

- An Australian Bank Account with another financial institution – this needs to be in the Business’ name as it will be used to pay funds into (such as interest you earn).

- An Australian mobile number and email address for verification and correspondence purposes. Each individual associated with the Business application will require their own unique email address and mobile phone number.

All Related Persons associated with the Business must also be:

- over 18 years of age;

- an Australian tax resident;

- not a foreign tax resident; and

- living at an Australian residential address.

There are some additional requirements depending on the Business type as mentioned within the eligibility criteria.

Q: Do all Related Persons need to fill out the online application?

A ‘Related Person’ is a person who is related to a Business entity seeking a term deposit, whose identity must be verified by us in accordance with applicable law.

The primary person applying on behalf of the Business must commence the online application and add a unique email address and Australian mobile phone number for each Related Person. Each Related Person will then receive an email from Judo Bank asking them to complete their part of the application by following the prompts.

Important: you must provide a unique email address and mobile number for each Related Person. Both the email address and mobile phone number for each person will be verified. We cannot open a Term Deposit for your Business, or accept any deposit, until we have satisfactorily verified the identities of all Related Persons.

Q: Why do I need to provide details of certain Related Persons associated with my business?

As part of our regulatory obligations, we need to be able to identify and verify certain Related Persons associated with your Business. As part of your online Business Term Deposit application, you’ll be asked to provide a unique email address and a unique Australian mobile phone number for each Related Person. Both the email address and mobile phone number for each person will be verified as part of the application process.

Q: Do my documents need to be certified?

Yes, all documents that you wish to provide to Judo Bank must be certified by approved certifiers under applicable law.

Q: When do I receive my account number?

Provided your Business meets the eligibility requirements for a Business Term Deposit (including receipt by Judo Bank and verification of any required certified documents), all nominated Related Persons to the application have completed their portion of the application, and all Related Persons meet the identity verification requirements, you will receive your account number via SMS message to your Australian mobile and/or via email.

Q: Is my Business Term Deposit covered under the Australian Government guarantee?

Yes, Term Deposits with Judo Bank are covered up to a limit of $250,000 for each account holder under the Government's Financial Claims Scheme (FCS). For example, under the FCS, a group of individual trustees of a trust or superannuation fund are treated as a single account holder. You can find out more about the FCS at www.fcs.gov.au

Q: Can I open a Business Term Deposit as a current Personal Term Deposit customer?

Yes, if you are an existing Personal Term Deposit product holder, you can open a Business Term Deposit for your business provided it meets the eligibility requirements. As an existing customer, you will not be required to verify your identity again, however, you will need to provide all necessary information for the Business and any other Related Persons.

Q: Can I open a Business Term Deposit for a company established overseas?

No, the account holder must have an ABN and other required business identifiers (you cannot proceed without the required identifier) and have an Australian business address. The account holder and all Related Persons must be Australian tax residents.

Q: I’ve already got a Judo Bank Loan product, why do I need to provide all my details again when applying for an online Business Term Deposit?

As part of our regulatory obligations, we need to collect and verify information when you apply for new products with Judo Bank. The information we require will be described in the online application process, however, if you need help or have a question, you can contact us by calling 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) or by sending an email to customers@judo.bank.

Q: Can my relationship banker set up and manage my online Business Term Deposit for me?

No, our online Business Term Deposit products have been developed as simple, no fuss, online products so they can’t be managed by your relationship banker on your behalf. We’ve built our online Term Deposits with the aim of providing an easily self-managed experience and, importantly, a market-leading rate. Unlike other products, deposit products are relatively simple - no detailed credit assessment is required, and the business information required generally relates to verifying the business’ identity and status (including tax residency status).

Q: What happens when I apply for a Business Term Deposit online?

All the information you are likely to need to complete your application for your business is outlined before you start your application. Please have it handy in order to make the application process easier for you. Once you have completed the application, we will undertake all the checks required to verify information about the business and the Related Persons connected to the application. If we need any other information, we’ll be back in touch with you to let you know.

Please note that a Business Term Deposit is only available where you meet the general and eligibility requirements set out in our terms and conditions. For example, if we are unable to verify your identity or that of any Related Person (such as an authorised representative of, or intermediary for, the business) then we may not be able to open an account for your business or accept any funds in relation to it. If your application is approved and your account is opened, you will receive an email and/or SMS confirming all the details you will need to be able to fund your new Business Term Deposit account.

Q: What happens if my online Business Term Deposit application was unsuccessful?

If you’re application is unsuccessful, we’ll touch base with you via email to advise that we have been unable to open the account for you.

Q: What happens when my online Business Term Deposit is nearing maturity?

All information about a maturing online Term Deposit account, including the opening date and maturity date, can be found in your Digital Banking profile. To change your maturity instructions, log in to Digital Banking and click on the Term Deposit you wish to amend. Then go to the “Maturity Instructions” heading above the account overview. Your current maturity instructions are shown under the “What will happen at maturity” heading. You can modify the maturity instructions as you require by clicking on the Edit button on the right-hand side. We will also send you a couple of reminders via email before your online Business Term Deposit matures. Note: Changing your maturity instructions via Digital Banking will be subject to the process and applicable cut off times set out in the terms and conditions for our Digital Banking Services. You will need to let us know what you would like to do with your funds before maturity within these cut off times, otherwise, your maturity instructions will default to reinvestment of the entire account balance as at the maturity date into a new online Business Term Deposit, subject to the 10-calendar day grace period that begins on the maturity date (during which time you can still choose to withdraw, top up, change terms or transfer the funds in your account without incurring any penalties).

Q: Do you offer a loyalty bonus for Business TDs?

We don’t offer a loyalty bonus for our Business Term Deposits products, but we seek to ensure that we offer you market-leading interest rates.

Q: Can my relationship banker see what online Business Term Deposit(s) I hold, what interest I’ve earned, and when my online Business Term Deposit(s) mature?

No, our online Business Term Deposit products have been developed as simple, no-fuss, online products, so they cannot be viewed or managed by your relationship banker on your behalf. We have built our online Business Term Deposits with the aim of providing an easily self-managed experience and, importantly, a market-leading rate. Via our web-based Digital Banking platform, online Business Term Deposit account holders can see what interest applies to their account and when the term deposit matures.

Q: How do I make changes to my online Business Term Deposit account information if any of my business details or Related Persons change?

If your business or a Related Person undergoes a change, you will need to notify us by calling 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) or by sending an email to customers@judo.bank so that we can remove, replace or add any other Related Persons or amend any of your business details. We may need some supporting documentation related to the change in order to process your request (for example, if we need to identity verify any new Related Person as required by law).

Q: If my business has a structural change, can I change directors on my deposit?

If your business undergoes a structural change, you will need to notify us by calling 13 JUDO (13 5836) Monday to Friday 8:30 am to 5:30 pm Melbourne time (excluding public holidays) or sending an email to customers@judo.bank so that we can remove, replace or add any other trustees/directors/office holders. We will need some supporting documentation that details the change to process such a request.

Q: Can I withdraw my online Business Term Deposit early?

When you invest in a Term Deposit, you are investing a fixed amount, for a defined term at a fixed rate. If you wish to withdraw money from your Term Deposit before the agreed Maturity Date you will need to submit a valid request so please contact us by calling 13 JUDO (13 58 36) to commence an early withdrawal request.

You must give us no less than 31 calendar days’ notice before you need the funds (the notice period commences on the Business Day we receive your valid request), unless proven financial hardship applies. However, it if your Term Deposit has less than 31 calendar days remaining until its maturity date, the earliest you may access the funds is at the maturity date, unless financial hardship applies.

We are entitled to make a Prepayment Adjustment to any early withdrawal before the Maturity Date, which takes the form of an amount equivalent to a reduced rate of interest that will be applied to the funds withdrawn. (See www.judo.bank/term-deposit-accounts-terms-and-conditions for further information).

If we allow you to break a Term Deposit prior to the maturity date, we will transfer the entire balance, less any outstanding fees, taxes, charges and the Prepayment Adjustment we are entitled to charge, electronically to your Nominated Account on the next applicable Business Day following the end of the 31-calendar day Notice Period (or earlier if financial hardship applies).

Funds can only be transferred to a verified nominated bank account. To ensure you have set up a Nominated Account for your Term Deposit, log in to Digital Banking then go to Payees>Add Nominated Account>Add. To finalise this change, we will need to verify that the change is being made by you by sending a verification code to your mobile phone. Please enter the code and click ‘Complete’. You can find step-by-step instructions on how to set up a Nominated Account here: www.judo.bank/help-hub/nominated-account-update

An early withdrawal request will be taken to relate to your entire Term Deposit balance, unless we agree otherwise, acting reasonably, and your account will be closed in accordance with the Terms and Conditions. If a partial early withdrawal is permitted (and only one partial withdrawal is permitted during the term), you must maintain a minimum balance of $1,000, unless we otherwise agree, or your account may be closed in accordance with the Terms and Conditions.

Important notice: While we have the discretion to deduct the Prepayment Adjustment from the principal or the interest of your Term Deposit payable at the termination date, we will generally deduct any Prepayment Adjustment from the accrued interest, unless paid interest instalments require us to deduct from the principal. We recommend you seek professional tax advice about the applicable Australian tax consequences to you of seeking an early withdrawal from a Term Deposit and the tax treatment of any Prepayment Adjustment.

No Question's Found!

SMSF Term Deposit frequently asked questions

Q: What is a Self-Managed Super Fund?

A Self-Managed Super Fund (SMSF) is a private superannuation trust structure that provides benefits to its members upon retirement. The main difference between SMSFs and other super funds is that SMSF members can either act as the individual trustees, or directors of the corporate trustee, of the SMSF and are responsible for the SMSF’s investments.

SMSFs can be single-member funds or have between two and six members.

Important note: Judo Bank only accepts applications for SMSFs with between two and four individual trustees or one corporate trustee. The ‘Applicant’ and ‘Related Parties’ are the trustee(s), or directors of the trustee, and members.

Q: Are all SMSFs eligible to apply for a Judo SMSF Term Deposit?

There are two types of SMSF that can apply for a Judo Bank SMSF Term Deposit.

-

Individual trustee(s) SMSF – each member is a trustee, with a minimum of two trustees required and maximum of four trustees accepted. We do not accept applications from single-member SMSFs at present.

-

Corporate trustee SMSF – a company acts as the trustee and each member is a director of the corporate trustee. Company establishment and ongoing fees are applicable with this structure and a director identification number is needed for each director. We do not accept applications from single-member/single-director SMSFs at present.

Only SMSFs with one corporate trustee (with at least two directors/members) or with two to four individual trustees are eligible to apply online and the applicant must supply:

- The SMSF's ABN and full name

- If the SMSF has a corporate trustee, the ACN and full name of the trustee

- The SMSF's nominated external bank account details

For each individual trustee, or director of the corporate trustee, Authorised Representative, Intermediary and/or Related Person they will need to be:

- over 18 years of age;

- an Australian resident for tax purposes; and

- living at an Australian residential address.

Q: How do I know if the trustee of my SMSF is an Individual or a Corporate trustee?

If you are unsure about any details of your SMSF, you can always refer to your Trust Deed or check with your accountant/financial advisor. A corporate trustee will generally have an Australian Company number or ‘ACN’.

Q: Do the Related Parties to the application (e.g. trustees or members) need to provide their TFN or ABN (if any)?

No TFNs or ABNs of individuals are required for the online application, only the ABN of the SMSF itself is required.

Q: Is a Judo Bank SMSF Term Deposit covered under the Australian Government guarantee?

Yes, Term Deposits (including SMSF Term Deposits) with Judo Bank are covered up to a limit of $250,000 for each account holder under the Government's Financial Claims Scheme. For SMSFs, the Term Deposit is set up in the name of the trustee(s) so the $250,000 limit applies in relation to the whole fund, not each individual member. You can find out more about the Financial Claims Scheme at www.fcs.gov.au.

Q: What interest rate will be applied to my SMSF Term Deposit?

The interest rate that will apply to your SMSF Term Deposit will be the current rate on the day your application is accepted and your SMSF Term Deposit account is opened. The applicable interest rate will be reflected in your Welcome Letter and in Digital Banking. You will then have 10 calendar days to fund the SMSF Term Deposit in order to lock in that interest rate. If you do not agree with the applicable interest rate reflected, please do not fund the SMSF Term Deposit.

Q: Can I have my interest payments paid to my personal bank account?

No, the nominated bank account that interest is disbursed to must match the name of the SMSF Term Deposit account.

Q: Do you offer a loyalty bonus for SMSF Term Deposits?

We don’t offer a loyalty bonus for our SMSF Term Deposits products but we seek to ensure that we offer you market-leading interest rates.