Welcome to the 2nd edition of the Judo Bank SMEconomics Report.

Our aim is to provide you with ideas - food for thought and discussion.

We don’t have all the answers, but we can have a go at making sense of the world we live, and do business in.

In the last edition, we laid some foundations for our thinking on economics. These included humility regarding economic forecasts; an awareness that each business has its own destiny, and an understanding that broad economic trends often don’t match how your business is travelling.

In this edition, we think about negative interest rates, what the sinking Australian dollar (AUD) might mean for you and we introduce you to the Judo Bank Index of SME Business Conditions.

Negative interest rates! You’re kidding me?

Sorry, we’re talking about negative interest rates for depositors not borrowers. Well, not yet - apparently, a few customers in Norway have negative interest rates on their mortgages. But that’s Norway.

So why are people in Australia talking about negative interest rates and what exactly does it mean?

I’m sure you’ve noticed that interest rates in Australia have fallen. The Reserve Bank’s (RBA) cash rate has fallen to 0.75% its lowest rate on record. And the RBA itself is hinting it might go lower.

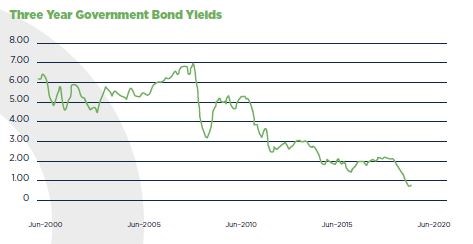

Yields in longer term markets have also fallen. Three-year government bond yields were 2.1% a year ago, today they stand at around 0.8%. Ten-year government bond yields were recently below 1%. If you looked at the trend, you could easily think yields were heading for zero, if not lower. But why?

There are plenty of reasons why interest rates fall.

Here’s a few. The RBA might want to stimulate economic activity. It might want to put downward pressure on the currency. There might be a belief that inflation is going to stay very low for a long time. Global savings might exceed the demand for borrowing. There could be an economic or political shock. Then there’s the dark art of ‘quantitative easing’ or QE.

QE is where the central bank, in our case the RBA, would buy bonds, and some other financial assets, using money it creates. Central banks can do that! When they buy billions of dollars’ worth of bonds, bond yields tend to fall. As yet, the RBA hasn’t tried QE, but it has been widely used in the US and Europe.

So, what does it mean for SMEs? Practically it means you, as a borrower, might get to borrow money at cheaper rates. I say might because the bulk of business borrowing in Australia is at variable rates and these are not dependent upon bond yields. They tend to move with shorter term yields such as 90-day bank bill rates.

Be aware that if the RBA needs to implement QE, this tells you that the environment into which you’re trading is pretty soft. QE is a last-ditch measure. It’s what central banks do to stimulate the economy when they have virtually no other options.

QE can lead to negative deposit rates. It’s not great news for savers and retirees. Indeed, a key aim of QE is to entice savers and retirees to invest in, or lend money to, institutions that can give them better returns.

Ask yourself, if interest rates were lower than today’s rates, could you find avenues of business that would generate good returns? If so, go for it. Create profits and jobs.

Not everyone is keen on QE and negative interest rates. What are the long-term consequences? Won’t it just push up the price of shares and housing? How will retirees cope? What happens to markets when the policy is reversed?

The polite name for QE is ‘non-conventional’ monetary policy. Its detractors have far less polite names and fear it will damage the long-run financial stability of the economy.

In Australia, we’re not yet at the point where QE is required but the RBA is certainly entertaining the possibility that it may be needed. Time will tell, and much depends on global and domestic economic conditions. Speaking of which...

Welcome to:

The Judo Bank Index of Small Business Conditions

Searching for a measure of SME business conditions is like searching for the Holy Grail. Do we really know what it looks like? And why do we want it?

At Judo we set out searching for a holy grail (a measure of SME business conditions) and ended up with a coffee mug!

That’s not as bad as it sounds. If all we wanted was ‘a drink’, a coffee mug is fine.

The Judo Index of SME Business Conditions is like a coffee mug. It serves its purpose. It gives a feel for the real world and how that might be impacting upon SMEs.

We all know that the best measure of an SME’s business conditions is the instinct or gut feel of the owner or management. You know best your order book, the mood of your clients, the challenges of finding skilled workers and the cost pressures you face.

We could ask you all how you’re feeling and come up with an average. That might work, but who’s average? And would you tell the full truth? Maybe, maybe not!

So how did we build our ‘coffee mug’, sorry, our Index of SME Business Conditions?

We could have simply taken the ABS measure of GDP and rebadged it – but that would most likely be illegal. A bad idea. Apart from being a bad idea, movements in GDP may not reflect the world of SMEs.

Exports (part of GDP) are dominated by mining giants and other business giants, as are large swathes of business investment. GDP has many moving parts, but not all are related closely to SMEs.

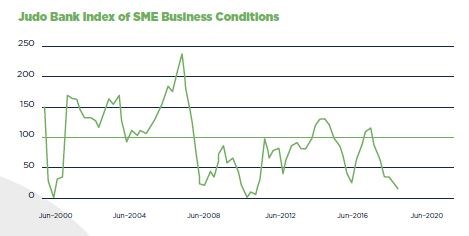

The Judo measure tries to keep it simple and relevant. We’ve chosen four measures in which SMEs have substantial skin in the game. The retail sector, job creation, business credit and housing approvals. If these sectors are firing, we believe it’s reasonable to say that business conditions for SMEs will also be firing. And vice versa.

Hang on! What about interest rates and the currency? Surely, they play a role in business conditions! Yes, they do, but not in a way that adds value to the index. Interest rates move in response to the sectors already in the index.

And the currency? It’s not in the index because many SMEs are assisted by a falling currency and just as many are hindered by it. And vice versa. Rather than muddy the waters with items that had no clear impact, and added no value, we left them out.

Each quarter we’ll tell you how the basics are traveling. Are business conditions improving or declining for SMEs and why?

As we said earlier, you know your business the best. Compare your knowledge of your business conditions with our Index and think about why you agree or disagree with the Index. Why not talk it over with your Judo business manager? They may even shout you a coffee!

We know that thinking and talking about macro-economic factors isn’t everyone’s cup of coffee but having a handle on the big picture isn’t such a bad thing. It may come in use when thinking about expanding, battening down the hatches or contemplating the pressures on interest rates.

The November issue of the Judo Bank Index of SME Business Conditions saw a further dip in conditions. Growth in employment and business credit were weaker than the previous reading while building approvals and retail sales went backwards.

Conditions are still well below average and the weakening trend, seen since early 2018, is continuing.

Is this what you’re seeing in your business?

How to read the index.

The long-term average of the index is 100. A result below 100 suggests SME business conditions are below the long-term trend. A result below zero tells us that conditions are going backwards!

The chart above tells us that SME business conditions are well below trend and have softened significantly over the past few years. Conditions have been better, but they are not hopeless.

The weaker AUD will help some businesses as will lower interest rates. There were also some stimulatory measures in the last Federal budget that may kick-in in the months ahead. These included changes to the instant asset write-down thresholds and tax cuts for some individuals. Drought relief measures are on the way.

With long-term interest rates at historically low levels, one wonders whether the government might borrow funds to build assets that will generate good returns for the wider community. They could include power generation assets, water provision assets, transport assets, hospitals, schools and so on. Not everything has to be on the billion-dollar scale. Local and state governments have their wish lists and the potential for utilizing SMEs is real.

We can but dream!

Some mildly ‘technical’ stuff.

The Judo Bank Index of SME Business Conditions uses annualised changes in employment, retail spending, business lending and building approvals to gauge conditions for SMEs.

Each component has its own degree of variability. Building approvals and business credit tend to have larger variations than employment growth and retail spending. Adjustments are made to account for these variations such that no one measure dominates the index. The underlaying data collected by the Australian Bureau of Statistics and the RBA is publicly available. Where applicable, adjustments are made for inflation and seasonality.

The sliding AUD...

If you compete against imports, rejoice. If your equipment and business supplies come from offshore, ouch.

When it comes to currency you can’t please everyone. If currency plays a major role in your operations, there’s always the possibility of hedging or insuring your currency risk.

As noted last quarter, there aren’t a lot of forces lining up to push the AUD higher. Australian interest rates are falling, economic growth is tepid and commodity prices are at risk of falling due to slower global growth stemming from the US-China trade tensions. Things can turn around quickly. Trade deals can be negotiated, and the RBA may, in time, keep interest rates stable.

An AUD at US65 cents by Christmas is entirely possible. It could even get there earlier. An AUD above US70 cents by the end of the year seems unlikely and would require a lot of positive changes in the outlook for the Australian and global economies. AUD movements are risks that can be managed.

And sliding interest rates

The RBA is well aware that Australia is far from full employment. In order to reduce spare capacity in the economy, the RBA governor has said that he would appreciate it if the government sector would add more stimulus to the economy. At present that just isn’t forthcoming. Maybe there will be a mini budget in December but don’t hold your breath.

The market expects the RBA cash rate to fall further, moving to 0.5% later this year or early next. Given what the RBA has said, this seems entirely reasonable. What do you think?

We hope you enjoyed reading this as much as we enjoyed preparing it for you. Stay tuned for the next edition of the Judo SMEconomics Report.

Related Blogs

This document has been prepared by Judo Bank Pty Ltd ABN 11 615 995 581 AFSL 501091 (“Judo Bank”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, Judo Bank recommends that you consider whether the advice is appropriate for your circumstances.

So far as laws and regulatory requirements permit, Judo Bank, its related companies, associated entities and any officer, employee, agent, adviser or contractor thereof (the “Judo Bank Group”) does not warrant or represent that the information, recommendations, opinions or conclusions contained in this document (“Information”) is accurate, reliable, complete or current. The Information is indicative and prepared for information purposes only and does not purport to contain all matters relevant to any particular investment or financial instrument. The Information is not intended to be relied upon and in all cases anyone proposing to use the Information should independently verify and check its accuracy, completeness, reliability and suitability and obtain appropriate professional advice. The Information is not intended to create any legal or fiduciary relationship and nothing contained in this document will be considered an invitation to engage in business, a recommendation, guidance, invitation, inducement, proposal, advice or solicitation to provide investment, financial or banking services or an invitation to engage in business or invest, buy, sell or deal in any securities or other financial instruments.

The Information is subject to change without notice, but the Judo Bank Group shall not be under any duty to update or correct it. All statements as to future matters are not guaranteed to be accurate and any statements as to past performance do not represent future performance.

Subject to any terms implied by law and which cannot be excluded, the Judo Bank Group shall not be liable for any errors, omissions, defects or misrepresentations in the Information (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the Information. If any law prohibits the exclusion of such liability, the Judo Bank Group limits its liability to the re-supply of the Information, provided that such limitation is permitted by law and is fair and reasonable.

This document is intended only for clients of the Judo Bank Group, and brokers who refer customers to the Judo Bank Group, and may not be reproduced or distributed without the consent of Judo Bank.

The Information is governed by, and is to be construed in accordance with, the laws in force in the State of Victoria, Australia.