Welcome to the 1st edition of the Judo Bank SMEconomics report – ‘Calling it as it is’. Here we explore a few key topics particularly relevant to SMEs and provide you with some ideas. We don’t have all the answers but between us we can work things out...

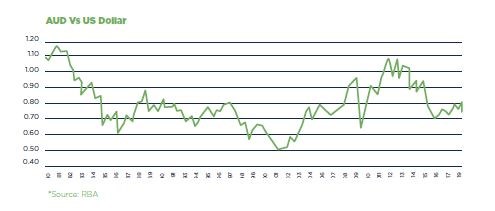

In this edition we lay the groundwork. Is the business environment for small and medium sized enterprises (SMEs) getting harder? How low can interest rates go? How low can the Australian dollar (AUD) fall? Why is, or isn’t, my business growing?

A word about forecasts and forecasting

In earlier times, fortune tellers used cards, chicken innards and tea leaves to predict the future. Today we have fortune tellers / economists telling us what the future holds. The methods are different but have the outcomes improved? Hopefully, yes!

The truth is that no one knows the future, be it the fortunes of an ancient battle, next week’s movement in the Australian dollar or traffic flows in Brisbane and Sydney tunnels.

Forecast models can be helpful. They make us think about our assumptions and about the strength of relationships. If commodity prices rise 10% what measurable impact does that have on the value of the AUD? And what happens if interest rates are falling at the same time?

History allows us to estimate these relationships, but reality insists that other factors are always at play. Like it or not, all ‘modelling’ and forecasts contain elements of subjectivity. It’s a case of ‘buyer’ beware.

A healthy dose of ‘forecast scepticism’ never goes astray if you’re putting your hard-earned cash – or borrowed money – on the line. Keep these thoughts in mind as we consider the outlook for the AUD and interest rates further on in the report!

Thankfully in financial markets, one can take out ‘insurance’ against unknown futures.

Is it getting harder out there?

The simple answer is ‘yes’. Economic growth has slowed but it certainly hasn’t stopped. As always there are pockets of growth, pockets of stability and pockets of desperation.

Retail spending has slowed. Back in 2014, sales were growing 6% per year. Today the figure is closer to 3%. Not zero, but very sluggish especially after adjusting for inflation. Is this sluggishness because wages are growing slowly or are we spending more on mortgages, rent and energy?

What else has weakened? Have a look at building approvals. In January last year approvals across Australia were running close to 20,000 per month. By May this year they were down to 14,800 and falling. A lot of businesses ‘hang off’ the construction sector.

Is it all bad news? Of course not. Mining has rebounded, the education sector is strong, manufacturing is finding profitable niches and jobs in health and professional services are growing.

Doomsayers have been confidently proclaiming a recession in the year ahead for at least the past ten years. One day they’ll be right. Until then, sources of growth include population growth, government spending on infrastructure, exports, lower interest rates and the steady impact of a weaker Australian dollar.

One concern often heard is Australia’s level of household debt. Without doubt it is close to record levels, pushed up mostly by borrowing for housing. Debt will be a real problem if interest rates were to rise or if unemployment were to head steadily upwards.

At present interest rates are low and falling and the unemployment rate is still hovering around 5%. Of the two risk factors, rising unemployment is the most likely over the next year, however interest rates could fall further in an effort to combat rising unemployment and government stimulus spending could rise.

How concerned are consumers? Judging by consumer sentiment, they’re taking it all in their stride. Consumer sentiment has been broadly steady for the past few years. Maybe consumers are in a state of denial or they simply trust the authorities to keep the economy going.

What do you think?

A recession in Australia in the next twelve months is possible but not probable. The factors dragging us back are currently outweighed by the forces pushing us forward. Be alert, but not alarmed, as someone once said.

If you’re energetically interested in the outlook for the Australian economy, why not take a peek at the CSIRO’s recent study ‘What kind of country will Australia be in 2060?’ Some very good food for thought.

Forecasts

-

Interest rates – short term - The Reserve Bank of Australia (RBA) cut official interest rates in June and July because of spare capacity in the labour market (unemployment and underemployment). By reducing the pressure on borrowers, the RBA hopes consumer and business spending will rise. To get the unemployment rate below 5% another cut may be needed. A cash rate of 0.75% seems likely by the end of the year.

-

Interest rates – longer term – 10-year bond yields are at historically low levels. Low inflation and concerns about weak domestic and global growth should keep them down. Rates will only rise when the outlook is for stronger economic growth combined with rising inflation.

-

The AUD – lower interest rates in Australia suggest a weaker AUD. However, if the US cuts its official interest rates the AUD could pick up. Commodity prices are firmer than most expected, and this supports the AUD. If China’s growth were to slow and if commodity prices were to weaken, the AUD would come under considerable downward pressure. In case you missed it, the latest AFR economist’s survey has a range of US 62-75 cents by year’s end. An AUD at close to US70 cents seems likely by Christmas.

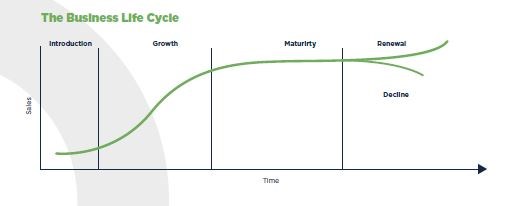

The business life cycle

There are over 2 million SME businesses in Australia. If we take out sole traders, there’s still over one million.

Each SME is at a different stage of their life cycle. Some were started in the 1950s others just last year. Some have thrived, others have struggled, and many sit somewhere in-between.

Where is your businesses in its ‘life cycle’? Do you think it has one? And importantly, where are you in terms of your business goals and aspirations?

Back in the 1920s biologists were describing the life cycle of organisms in terms of development, growth and decline. Social researchers in the 1950s began applying the life cycle analogy to businesses.

The early focus was on the development within firms of governance processes, management styles, marketing practises and financing needs.

Just as butterflies go through stages – egg, caterpillar, chrysalis, adult butterfly, egg – so firms were also seen in the same terms.

Descriptions of the stages of firms have included concept, foundation, expansion, stabilisation and niche development. Another set is creativity, direction, delegation, co-ordination and collaboration. One set particularly caught our eye – wonder, blunder, thunder and asunder. We’re not sure if the later firms blow themselves up or diversify!

Management textbooks often portray the business life cycle as an S-curve chart.

SO WHAT’S THE POINT?

Business life cycle theory can provide a framework for thinking about your business. It doesn’t tell you what to do nor does it tell you where you are going.

What it can do is point out the challenges that each stage of growth poses. What skills will I need? When do I start delegating? How do I delegate? When do I upgrade my accounting system? How do I finance the next stage? Can I develop new product? The list goes on, but as you well know, the challenges are endless, as is the competition.

While your business is as unique as you, it will face the same threats and opportunities as countless other firms before you. Business life cycle theory exists to help. It may never fit your business exactly, but it can give you ideas and direction. It can help you determine your own goals and timeframes.

One approach had the following stages:

Stage 1 Pre-venture: This stage is where the vision, the ideas and the options are canvased

Stage 2 Infancy: The business is launched, and sales are made

Stage 3 Early Growth: The business has moved beyond break even. There are healthy profits. There is cash flow to repair or replace assets

Stage 4 Expansion: Cash flow is good but insufficient to fund the assets required to meet increasing demand

Stage 5 Maturity: A strong market position, strong cash flow and strong profits. The challenge is to avoid stagnation

Stage 6 Decline: Risk avoidance and possibly complacency sets in. Competition grows and there can be a loss of entrepreneurial spirit

None of this is predetermined or predictive. It’s a framework, an aid to thinking. It might be useful in your situation. Each life cycle theory has its stages and more detail on what each stage looks like. Our hope is that you get the drift and that it gets you thinking about your business.

At the end of the day, it’s the skill set of the businessperson and their goals that determine how a firm moves through its own life cycle.

In all stages, Judo and its representatives are here to help.

Key learning from the Sensei

Why should the Australian dollar (AUD) fall if the Reserve Bank of Australia (RBA) cuts interest rates?

The level, or price, of the AUD, like many other things, is determined by the demand for Australian dollars. Strong demand sees the AUD rise, falling demand sees the AUD fall.

Money, or capital, flows around the world seeking the best returns. Interest rates are the ‘return’ owners of capital get for placing their funds in AUD accounts. Just like term deposits, people prefer, or demand, higher interest rates or higher returns.

If Australia cuts its interest rates, some owners of cash or capital will take their money elsewhere. Demand for the AUD falls. They may choose to place their capital in New Zealand or the United States where interest rates are higher. The demand for Australian dollars falls and so the price, or exchange rate, falls.

Even the expectation of falling interest rates can weaken the AUD. Why wait for the RBA to cut rates, get out now! And so, demand for Australian dollars declines and the AUD falls.

The opposite occurs when interest rates rise. A rate rise attracts capital, it lifts demand. Owners of capital prefer higher interest rates. Demand for Australian dollars increases and so its price or the exchange rate rises.

OK, let’s stop there and talk about the real world!

Interest rates are not the only thing affecting exchange rates. The world never stands still and nothing in economics travels in a straight line. The real world is complicated, it’s messy. And so are exchange rates.

There are some countries that put up their interest rates and still no one wants to put their money there. Some South American countries come to mind. Their interest rates might be high, but will you ever get your money back? Mismanagement of an economy can lead to a very weak currency.

Do you recall the famous quote by Paul Keating in 1986 about Australia possibly becoming a thirdrate economy, a banana republic? The AUD fell 3 US cents immediately after he said it! No change in interest rates but a huge change in the exchange rate.

To make the world less messy, economists use the delightful phrase ‘other things being equal’. If interest rates fall and nothing else changes (as if!) then the AUD would fall.

In the real world, the best we can say is that if Australia’s interest rates fall, there is a tendency for the AUD to weaken. But it may not!

Thank you for reading. We look forward to sharing with you the next edition of the Judo SMEconomics Report!

Related Blogs

This document has been prepared by Judo Bank Pty Ltd ABN 11 615 995 581 AFSL 501091 (“Judo Bank”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, Judo Bank recommends that you consider whether the advice is appropriate for your circumstances.

So far as laws and regulatory requirements permit, Judo Bank, its related companies, associated entities and any officer, employee, agent, adviser or contractor thereof (the “Judo Bank Group”) does not warrant or represent that the information, recommendations, opinions or conclusions contained in this document (“Information”) is accurate, reliable, complete or current. The Information is indicative and prepared for information purposes only and does not purport to contain all matters relevant to any particular investment or financial instrument. The Information is not intended to be relied upon and in all cases anyone proposing to use the Information should independently verify and check its accuracy, completeness, reliability and suitability and obtain appropriate professional advice. The Information is not intended to create any legal or fiduciary relationship and nothing contained in this document will be considered an invitation to engage in business, a recommendation, guidance, invitation, inducement, proposal, advice or solicitation to provide investment, financial or banking services or an invitation to engage in business or invest, buy, sell or deal in any securities or other financial instruments.

The Information is subject to change without notice, but the Judo Bank Group shall not be under any duty to update or correct it. All statements as to future matters are not guaranteed to be accurate and any statements as to past performance do not represent future performance.

Subject to any terms implied by law and which cannot be excluded, the Judo Bank Group shall not be liable for any errors, omissions, defects or misrepresentations in the Information (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the Information. If any law prohibits the exclusion of such liability, the Judo Bank Group limits its liability to the re-supply of the Information, provided that such limitation is permitted by law and is fair and reasonable.

This document is intended only for clients of the Judo Bank Group, and brokers who refer customers to the Judo Bank Group, and may not be reproduced or distributed without the consent of Judo Bank.

The Information is governed by, and is to be construed in accordance with, the laws in force in the State of Victoria, Australia.