SMEconomics Overview: Australia's economy has a strong platform to grow in 2022

-

The Australian economy is recovering vigorously from the delta lockdowns that ran from June to October. We are seeing a strong bounce in consumer spending and business confidence in the final months of 2021 in the locked down States and Territories: NSW, Victoria and the ACT.

-

The other States and Territories have shown remarkable resilience to the lockdowns in the south-east with South Australia, Western Australia and Tasmania all registering record high levels of economic activity over the second half of 2021. These economies will benefit from the recovery in the national economy in 2022.

-

The resilience of the Australian economy to strict health orders was demonstrated in the September quarter National Accounts. Although GDP fell 1.9% in the quarter, it was a strong result. With more than 60% of Australians in the locked down States and Territories, consumer spending declined 4.8%. In NSW and the ACT, consumption fell by more than 10%. Government income support programs, business investment and a favourable trade outcome cushioned the blow to the economy from this historically large decline in household demand.

-

The business community is optimistic about Australia’s economic prospects. Various measures of business confidence across SMEs and large corporations are at high levels. Investment intentions are strong, with the Australian Bureau of Statistics (ABS) survey pointing to a 10% lift in investment in the 2021/22 financial year.

-

Business profitability has held up despite the various uncertainties and costs associated with the pandemic. Government income support programs have been important, particularly for SMEs in exposed service industries. Strong domestic demand and low interest rates are a positive. But there are many changes, not least rising costs pressures, disrupted supply chains and a shortage of suitable staff.

-

**Labour shortages are going to continue to be a major issue in 2022. All indicators of labour demand are at the highest levels ever seen, yet the closed international border means the supply of new workers into the economy is the weakest in decades. The government is attempting to relieve labour shortages with targeted immigration programs, but it is not clear that this will address the problem.

-

Consumer confidence has steadily improved over the second half of 2021 following the initial shock of the delta lockdowns. Most sentiment measures are above long-run average levels and squarely in optimistic territory. Retail sales surged 4.9% in October as restrictions were eased in NSW, Victoria and the ACT. Australian households have accumulated $356 billion of savings in bank accounts through the pandemic. Estimates of desired saving over this period are closer to $200 billion, implying a significant ‘war chest’ of cash ready to be deployed into the economy.

-

Inflation is a major uncertainty for 2022. Despite a benign view of the inflation outlook from the government and the RBA, the reality is global inflation pressures are building, and eventually this will impact Australia. There is a real risk that inflation will intensify in 2022 and raise the prospect of higher interest rates before the end of the year.

-

Housing markets are starting to ‘cool’ at the end of 2021. New regulations for banks will increase the cost of, and reduce the access to financing. This should see house prices rise at a much slower pace in 2022 than we have seen over the past 18 months.

Australia's Two Speed Economy to end in 2022

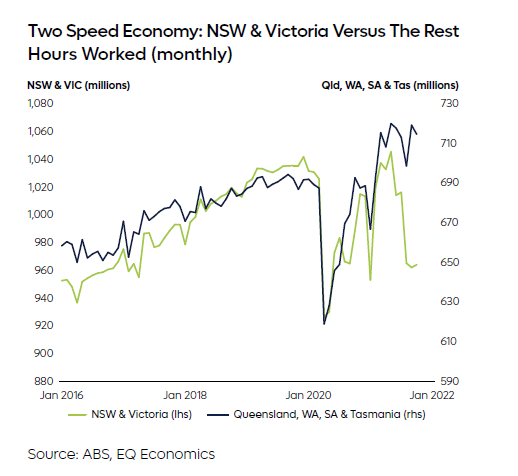

While 2021 was a story of recovery, it was also a story of a two speed economy in Australia. The emergence of the delta strain of COVID-19 in 2021 drove extended lockdowns in the South-East of Australia while the rest of the country remained largely open.

NSW, Victoria and the ACT were in extended lockdown through winter and into spring which resulted in a sharp drop in economic activity. NSW was hardest hit in July and August, with hours worked across the state dropping below the low point of the lockdowns in March/April of 2020. The ACT was also hit hard, and Victoria experienced a large drop in hours worked, although the low point in October is expected to be above the level seen over the second half of 2020.

As these state economies opened in October and November economic activity is expected to jump sharply higher, driving a recovery in national economic activity which is expected to get above pre-pandemic levels early in 2022.

What has been most surprising has been the strong performance of Western Australia, South Australia and Tasmania. Despite closed internal and international borders these economies have gone from strength to strength in 2021.

As the chart highlights the open economies outside of the south-east of Australia have maintained hours worked (a good proxy for economic activity) near the record high levels seen in May 2021. The locking down of NSW and Victoria appears to have had a minor impact on economic momentum in Western Australia, South Australia and Tasmania, which have all continued to grow through the delta lockdowns.

Queensland’s economy has been impacted by the lockdowns in NSW and Victoria, particularly in the winter months, but has started to recover strongly in September and October. The relative performance of the various state economies suggests that Queensland’s economy is more linked into the NSW and Victorian economies than those of Tasmania, South Australia and Western Australia.

The hours worked data highlights the severity of the downturn in economic activity in NSW and Victoria, and equally remarkable, the resilience of the rest of Australia to the lockdowns in the two biggest states.

As 2021 ends the strong performance of the open state economies should provide us with some optimism that the NSW and Victorian economies will bounce back strongly in late 2021 and early 2022. This will be a major driver of strong national economic growth in late 2021 and early 2022, and could see the level of economic activity exceed previous highs of the June quarter 2021 by the middle of 2022.

The bringing down of internal borders and the opening of international borders will be another factor boosting economic activity in 2022. This should end the two speed economy of 2021 and see all the States and Territories of Australian experiencing strong economic conditions in 2022.

Insolvency rates set to rise in 2022, but not by much

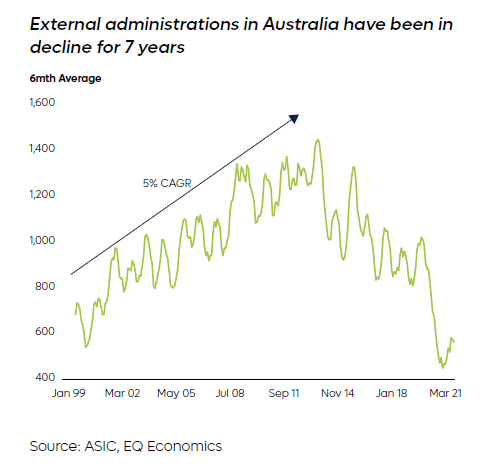

One of the most important emergency policy measures put in place at the start of the pandemic was changes to insolvency procedures to allow businesses to remain alive through lockdowns. The result was a decline in insolvency proceedings to the lowest level in 20 years in 2020.

Many countries adopted similar insolvency policies, resulting in a decline in insolvency actions of between 30% and 50% around the global economy.

The temporary suspension of insolvency laws came to an end in Australia in 2021, but despite further lockdowns and a challenging trading environment for many sectors, insolvencies have not surged. Warding off business failure has many dimensions, not least the attitude of banks and the Australian Tax Office to foreclosure. Equally important has been the role of government income support programs for businesses and households in lockdown.

As the chart below highlights, Australian Securities and Investments Commission (ASIC) data show that insolvency numbers have increased only slightly in 2021 and remain near 20 year lows over the first nine months of 2021.

Many industry experts are expecting a big increase in insolvencies in 2022 as government income support programs roll off and enforcement activity steps up. The consensus in most markets is that insolvency numbers will return to pre-pandemic levels, a rise of about 30%. This would still be very low by historical standards.

Even before the pandemic set in, insolvencies were in decline in most advanced economies. Persistently low interest rates set by central banks have allowed many marginal companies to continue to service their debts despite weak profitability. These so-called ‘zombie’ firms would not survive if interest rates were at normal market determined levels.

The trend for falling insolvency rates and an increase in zombie firms has been evident for many years. Insolvency rates have been falling in the US, Japan and Europe for over a decade, reflecting low interest rates since the global crisis of 2008. Australia entered the ‘super-low’ interest rate world in the middle of the last decade (2014) as the commodity boom went into retreat and our economy struggled to generate high growth and inflation.

Low interest rates are going to remain a prominent feature of the global economy in 2022. Central banks appear to be in no rush to raise rates despite rising inflation. The global economy is expected to be strong. Australia could be about to experience a surge in economic growth in 2022 following the delta lockdowns of 2021.

This suggests that an expected rise in insolvency activity may be much smaller than industry experts predict. The real test of the resilience of the business community to insolvencies is unlikely to come until interest rates return to more normal levels, something few believe will happen in the next 2 years. The concern is that when rates do rise, they will rise quickly and insolvency rates could surge given the low levels experienced over recent years.

China’s economy to slow into a sustainable 4% growth path in 2022

China’s economic growth has slowed rapidly in 2021, partly a natural response to the COVID rebound which drove high growth rates in early 2021 and partly due to mounting economic challenges that Chinese authorities are trying to manage in an orderly fashion.

China’s economy is likely to experience a lower rate of growth over the next few years when compared to what was achieved prior to the pandemic when annual economic growth was regularly at or above 6%. In a country that has rapidly developed to be the second largest economy in the world, a growth rate closer to 3 or 4% is still a remarkable achievement. It is also a significant contribution to the world economy, with additional economic activity each year roughly equivalent to the overall size of the Australian economy.

A lower and more sustainable economic growth rate of 4% looks like the right approach for a government that is trying to manage multiple problems within its economy. The biggest threat is a property bubble, led by excessive building and investment in residential property. The recent problems that property developer Evergrande has faced highlight the need to gradually wind down businesses that are no longer solvent without creating a panic in the property market. The authorities appear to be slowly deflating the property bubble and winding down private financiers that have leveraged themselves to unsustainable levels of property prices and demand from investors.

While financial markets are worried about a financial crisis emerging in the wake of the Evergrande troubles, the authorities are opting for an approach which will result in an extended period of soft property activity that could last several years. The problem is chronic, but a crisis looks like being averted.

The Chinese government is also trying to contain energy consumption to achieve environmental goals. The rapid rebound in demand for manufactured goods as well as a strong domestic economy pushed many regional governments above their energy targets in early 2021. In many regions industrial activity has been curtailed to bring energy consumption down, which has not only hurt economic growth but also added to supply chain bottlenecks as factories operate well below capacity.

More broadly, global supply chain pressures have hurt economic activity in China as the shortage of semiconductors has impacted manufacturing activity, while disruptions to global shipping networks have impacted manufacturers ability to get their products to overseas markets. This has been partly responsible for the slowdown in Chinese exports this year.

The Chinese government has also had to instigate strict lockdowns as the delta strain of COVID 19 has popped up from time to time across the country. This has impacted consumer spending and retail sales, acting as another headwind to economic growth.

While the government will continue to push for a rebalancing of the property markets and energy consumption levels will be monitored closely, it is also attempting to stimulate economic activity through infrastructure investment and an easing of financial conditions outside of the property sector.

The worst of the squeeze on Chinese economic activity appears to be behind us, and although economic growth is unlikely to bounce back onto a 6% growth path, a more sustainable 4% rate represents a strong economy that will be an important element of global economic activity in 2022.

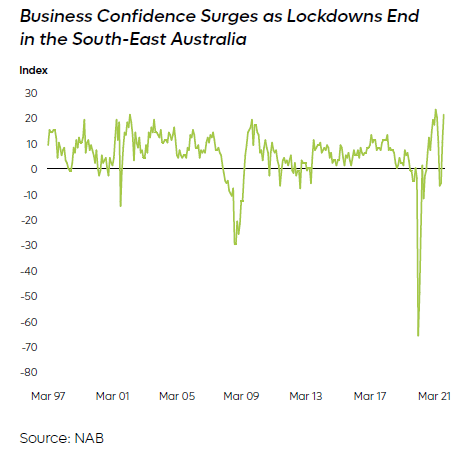

Business confidence: from gloom to boom in two months

Business confidence, based on the NAB survey, surged in October to the second highest level since the survey began in 1997. Confidence has staged a stunning turnaround as NSW, Victoria and the ACT have come out of lockdown rising from -8 points in August to +21 in October.

The surge in confidence has not been matched by business conditions, which are a better reflection of current trading conditions, which rose to +11 from +5 points in September. Both confidence and conditions hit a record high level earlier this year.

Trading, profitability, employment and forward orders all registered strong gains in October, reflecting a pickup in economic activity as restrictions were wound down across the southeastern states.

The rise in business confidence is a welcome sign that the economy is set to stage a strong recovery at the end of 2021 and into 2022, but there are some concerns underlying the otherwise optimistic disposition of the business community at the end of 2021.

Exports appear to be in the doldrums, according to the NAB survey, where the index came in at -2 points in October, the lowest reading since the pandemic began. The official export numbers are strong, although most of the growth in exports through the pandemic has been concentrated in key mineral and energy export industries.

Outside of mining and energy, exporters appear to be struggling despite a robust global economy and a moderate level of the Australian dollar. Trade tensions, supply chain disruptions and closed borders are clearly a headwind to our nonmining exporters, where the priority is finding new markets outside of mainland China.

Businesses are becoming increasingly worried about rising costs and supply chain disruptions. Labour and material availability as a constraint on business have both increased to be near the highest levels ever in October 2021. Labour availability as a constraint rose to +20 points, the same level seen at the height of the mining boom in 2007 and 2008. Labour shortages are clearly impacting a broad range of businesses.

The standout was the availability of materials, with 43% of businesses across Australia being impacted. This is almost double the previous high seen over a decade ago, and highlights that global and domestic supply chain problems are very real in Australia and not getting any better in recent months.

Cost and price pressures are rising across most parts of business operations, with most indicators of inflation pointing to high outcomes in 2022. It only makes sense that supply chain shortages and disruptions will eventually drive higher costs and final prices.

What is encouraging is the strength in business confidence. While supply chain issues and cost pressures will be a major challenge for business in 2022, the strength in underlying demand in the economy is keeping business optimistic, which should bode well for economic activity over the year ahead.

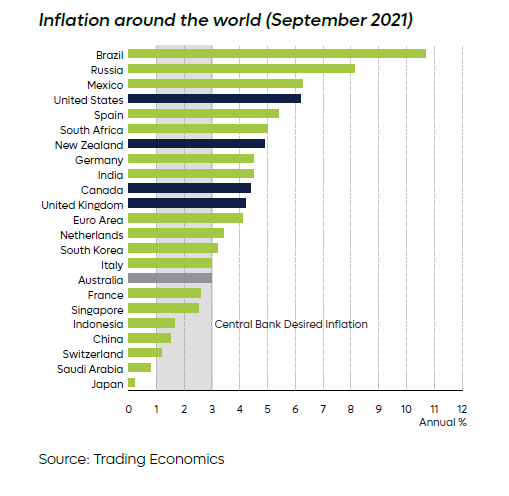

Inflation is rising all around the world

Australia’s rate of inflation eased in the September quarter, with the annual rate dropping from a decade high of 3.8% to 3%. This largely reflected the unwinding of COVID related factors impacting the numbers. At 3%, inflation is still high by recent standards and is at the top of the RBA’s 2% to 3% target band.

Core inflation, which attempts to strip out volatile temporary factors impacting the headline index, is on the rise. Core inflation surprised forecasters, rising by 0.7% in the September quarter to be 2.1% higher over the year. This is the highest reading in 7 years for core inflation, and the first time that core inflation has been within the RBA’s target band since 2014.

Although the numbers are high compared to where inflation has been in Australia over the last decade, the results are broadly in line with the RBA’s targets. This contrasts with inflation outcomes around the world, which are not only rising, but are much higher than central bank targets. Most central banks would like to see inflation at around 2% over time. As the chart highlights, the latest readings on inflation in most of the world’s major economies are well above that level.

Australia’s economy shares many similarities to the USA, UK, Canada and New Zealand. All of these economies are experiencing inflation above Australia’s current rate of 3%, with the US a standout at 6.2%. Some countries are experiencing severe inflation pressures. Many of the world’s largest economies are seeing annual inflation rates above 5%. There are also the low inflation countries, notably China and Japan, where inflation remains well below 2%.

Cost pressures have been building across the world economy in 2021. Supply chain disruptions, rising commodity prices and difficulties in the global transport and logistics networks are all putting upward pressure on prices. In many economies, businesses appear to be able to pass these higher costs onto consumers, hence the high rates of consumer price inflation in many countries.

This would explain strong business performance in the face of rising cost pressures, and is factor in supporting equity market valuations around the world. Indeed, the global equity markets are in a sweet spot, with rising inflation signalling strong profitability while central banks maintain ultra-low interest rates that support valuations and keep funding costs down.

It is only a matter of time before rising cost pressures show up as higher inflation in Australia. The harsh delta lockdowns in south-east Australia may have delayed business decisions to raise prices. As the economy recovers in 2022 there is every likelihood that inflation in Australia will increase as well. For the time being the RBA is prepared to look through a temporary increase in prices and hold interest rates at historically low levels. If inflation rises towards the rate we are currently seeing in other economies, the RBA may be forced to reassess their monetary policy in 2022.

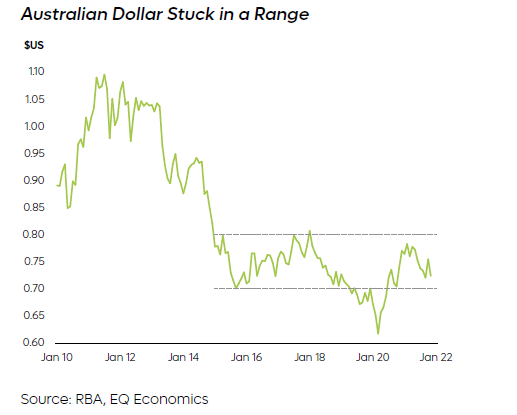

Australian dollar treading water in 2021

The Australian dollar has struggled over the second half of 2021 despite high export prices, a record trade surplus and a shift up in market interest rates. The currency appears to be stuck between US70c and US75c. A big decline in economic activity associated with the delta lockdowns in NSW and Victoria, as well as the 50% drop in iron ore price between July and September, have not helped sentiment towards the Australian dollar.

Apart from a sharp decline at the start of the COVID 19 pandemic, the Australian dollar has been trading in a US70c to US80c range for most of the last 8 years. This follows a period when the currency was very strong, trading up to a 50 year high of $US1.10 in 2011. As the commodity boom came to an end between 2011 and 2014, so too did the Australian dollar’s strength.

The range of the last 8 years is broadly in line with the long-run average level of the currency against the US Dollar. In this sense the Australian dollar is neither cheap nor expensive. What has been surprising in recent years has been the lack of response of the Australian dollar to strong global commodity markets, which have pushed up the price of our major exports.

Part of the reason for the unusually soft performance of the currency in the face of strong external trading conditions is the decline in foreign direct investment since the start of the pandemic. This has been a global phenomenon, but could be a particularly important factor for Australia given our long history of attracting investment from other countries.

Currencies are impacted by a complex range of factors, from trade and capital flows to tourism and market sentiment. The price of a currency in the market, the exchange rate, is the result of all these different market forces.

For this reason it is important to try and understand valuations from a long-term fundamental point of view. Purchasing power as measured by relative inflation rates is the most common way of trying to determine if a currency is expensive or cheap at any point in time. On this basis, the Australian dollar appears to be cheap by around 10-15% against the US Dollar.

Historically, it is commodity prices that have exerted a major influence on the Australian dollar given that commodity exports make up more than 70% of Australia’s exports. The volume and price of primary commodities can change quickly, and with it change the supply and demand balance in the market for Australian Dollars. On this measure, the Australian dollar looks cheap, even taking into account the big fall in iron ore prices this year.

Another prism through which the Australian dollar is often viewed is the health of the global economy. A strong global economy usually equals a strong Aussie dollar. It could be the trajectory for the global economy over the next few years that ultimately determines whether the Australian dollar breaks out of the 8 year trading range. One thing we can be confident of is a weak currency will surely follow a slump in the global economy. But this is not something that we expect to happen. More than likely, the Australian dollar looks like it will remain stuck in the US70c to US80c range.

Disclaimer

This document has been prepared by Judo Bank Pty Ltd ABN 11 615 995 581 AFSL 501091 (“Judo Bank”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, Judo Bank recommends that you consider whether the advice is appropriate for your circumstances.

So far as laws and regulatory requirements permit, Judo Bank, its related companies, associated entities and any officer, employee, agent, adviser or contractor thereof (the “Judo Bank Group”) does not warrant or represent that the information, recommendations, opinions or conclusions contained in this document (“Information”) is accurate, reliable, complete or current. The Information is indicative and prepared for information purposes only and does not purport to contain all matters relevant to any particular investment or financial instrument. The Information is not intended to be relied upon and in all cases anyone proposing to use the Information should independently verify and check its accuracy, completeness, reliability and suitability and obtain appropriate professional advice. The Information is not intended to create any legal or fiduciary relationship and nothing contained in this document will be considered an invitation to engage in business, a recommendation, guidance, invitation, inducement, proposal, advice or solicitation to provide investment, financial or banking services or an invitation to engage in business or invest, buy, sell or deal in any securities or other financial instruments.

The Information is subject to change without notice, but the Judo Bank Group shall not be under any duty to update or correct it. All statements as to future matters are not guaranteed to be accurate and any statements as to past performance do not represent future performance.

Subject to any terms implied by law and which cannot be excluded, the Judo Bank Group shall not be liable for any errors, omissions, defects or misrepresentations in the Information (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the Information. If any law prohibits the exclusion of such liability, the Judo Bank Group limits its liability to the re-supply of the Information, provided that such limitation is permitted by law and is fair and reasonable.

This document is intended only for clients of the Judo Bank Group, and brokers who refer customers to the Judo Bank Group, and may not be reproduced or distributed without the consent of Judo Bank.

The Information is governed by, and is to be construed in accordance with, the laws in force in the State of Victoria, Australia.