SMEconomics Overview

2020 has been a year unlike any other with the impact of the COVID pandemic being felt across the global economy. This edition of the Judo SMEconomics report examines the Australian economic landscape and provides insights into what the recovery looks like for Australian business now and into the future.

- Optimism is the best word to describe economic developments in Australia over the last few months. Great health outcomes, further economic policy stimulus and strong employment numbers have bolstered hopes that the economy can build further momentum into 2021.

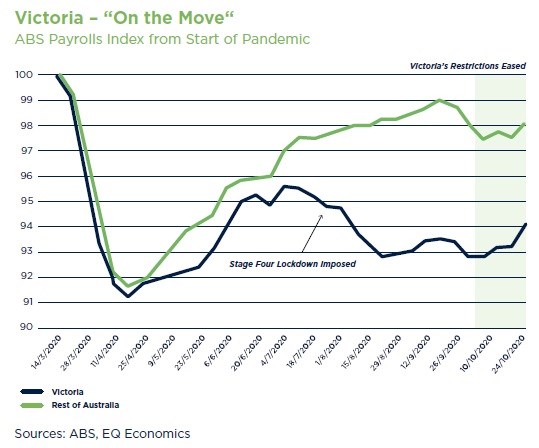

- Victoria is emerging from lockdown and the economy is bouncing back. Employment, mobility and spending data all point to a rapid catch up to the rest of the country over the summer ahead. There will be no rest for the wicked. Victorian’s are keen to get back to normal which could mean a busy summer for businesses making up for lost time.

- Australia’s suppression of the coronavirus is world leading. Community transmission is virtually non-existent in most parts of the country. Internal borders are opening ahead of Christmas which should add an extra tailwind to economic activity as we enter 2021.

- Great progress on vaccines has been a major factor supporting confidence. A community wide roll-out is still six to nine months away which means some social distancing and public gathering restrictions will be required for a while yet. With a pathway to elimination becoming clearer, Australian businesses should be thinking long and hard about investment opportunities.

- The Federal Government’s Budget provided a range of financial incentives for investment. These all have a relatively short life span which only adds to the urgency of investment planning and implementation. The extension of the instant asset write-off will only be available until June 2022.

- A strong second wave of the coronavirus is wreaking havoc in the US and Europe. These globally critical economies will have a long hard winter ahead and may set back the global economic recovery somewhat. China’s economy is going from strength to strength and with it our exports are rising to record high levels. China’s government is targeting some Australian exports with trade restrictions which could dampen the benefit to our recovery if the situation deteriorates.

- Australia’s residential property market is recovering from the pandemic slowdown with prices hitting new highs in most capital cities while new mortgage demand rises strongly. Even Melbourne’s property market is showing signs of life post lockdown. Property is a key barometer of Australia’s economic health. Low interest rates should drive further gains in property markets well into 2021.

- With the RBA’s benchmark risk-free interest rates now set at the historically low level of 0.10%, the focus of monetary policy has shifted from the price of money (interest rates) to the quantity of money in the financial system (quantitative easing or QE). The RBA’s commitment to buy government bonds should put downward pressure on long-term interest rates and the Australian dollar.

- The last two months have important implications for businesses in Australia. If the economy is recovering more quickly than previously thought, then business need to think about how to get ahead of that recovery. Planning has never been more important and a strong recovery and government incentives means there is no time to waste.

- The biggest potential headache for business from a strong recovery will be related to staff. Most industries have been shedding labour through the pandemic. Businesses have been worried about a tougher trading environment and the loss of revenue. A stronger than anticipated economic turnaround should result in a lift in the demand for new staff. Skill shortages and wage pressures could quickly emerge in parts of the labour market. Retaining and attracting staff could be a major challenge for 2021.

The Australian economy: building optimism

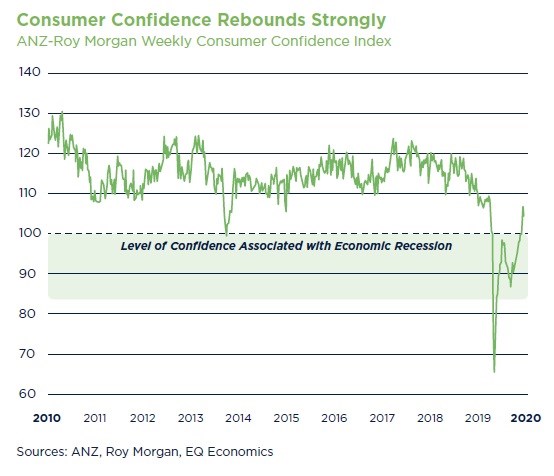

Sentiment towards the economy has clearly improved over the last few months as continued success with battling the coronavirus and a new wave of government policy stimulus boosts confidence that the recovery can build momentum as we head into 2021.

For some months we have had a good reason to believe in a strong economic rebound in 2022 and beyond. Recent economic data, low virus numbers and further government policy stimulus now suggest that the risk is for a stronger and earlier recovery than previously thought.

The most important new data on the Australian economy was the October employment report from the Australian Bureau of Statistics (ABS). This showed that Victorian employment has already started a strong recovery following the easing of restrictions but also highlighted continued improvement in employment across the rest of Australia. And this is despite the first stage wind down of JobKeeper in the month.

Australia generated 178,800 new jobs in the month and attracted over 200,000 new people into the workforce. Victoria alone created 82,000 jobs with total employment in the State just 4% below where it was before the pandemic. What has been truly remarkable has been the jobs recovery in the rest of the country where total employment is now just 1% below pre-COVID levels.

With the recovery in the labour market has been a recovery in consumer confidence. Consumer confidence slumped to record low levels as the coronavirus took hold of the global community earlier this year. As the first wave of the virus receded confidence recovered but was weak by historical standards. Since the end of winter confidence has broken higher and is now just a few percentage points below what would be regarded as ‘normal’; if there is such a thing.

Over the past six months the worry has been that the economic recovery will be slower and less robust than seen in past downturns. As we move into summer the risks have shifted towards an earlier and more robust recovery for Australia’s economy.

While this is good news it does present a new set of challenges for business; how to get ahead of a strong rebound in economic activity. The biggest worry will be on the staffing front. An earlier and stronger recovery could see the demand for certain skills picks up pace. Skills shortages could emerge, and wages respond. This is a key flash point for all businesses to be thinking about over the summer ahead.

There has been a raft of positive health news since the end of winter

With the easing of restrictions in Victoria has come increasing optimism that Australia’s economy can recover quickly. The early signs are encouraging with Victorian employment numbers picking up in October as restrictions have been eased. Most indicators of people movement and economic activity are improving rapidly in Victoria. This should build momentum into the summer months given the extremely low case count Victoria has recorded in November.

The NSW government's efforts to suppress the virus while managing a relatively open economy have also supported the view that we are through the worst of the pandemic. The NSW government has been a world leader in contact tracing and virus suppression. Numerous outbreaks have occurred since the start of Australia’s second wave in early winter. Suppression has worked and the economy has remained mostly open with social distancing and modest social gathering rules in place.

Other states have been successful at containing the virus but remain nervous about border opening. This has been a constant source of friction between state Labor Governments, the business community, and the Federal Government.

With national cases so low in November it looked like the border restrictions were about to come down. The latest SA outbreak has been a major setback to business and consumers. While it proved a false alarm, the damage was done, with other State premiers quick to reveal their hand and shut the borders with South Australia.

There has been great news on the vaccine front with multiple trials proving highly effective. First it was Pfizer and then Moderna who reported 90%+ efficacy in November. The University of Oxford and Astra Zeneca have also made significant progress through stage three trials. These rates of effectiveness are a game changer and once rolled out across the community will be a critical part of our ability to eliminate the virus.

A vaccine does not immediately result in elimination, but it will significantly reduce the restrictions we need to place on the community and the economy. A vaccine will take 6–12 months to roll out across the community with the most at-risk members of society the first in line. Consumer and business sentiment will receive a major boost once there is hard confirmation that a vaccine is ready to go and the timetable for roll out is published. A clear and reliable pathway to effective virus suppression will play a major role in boosting confidence that the global economic recovery is just around the corner.

Government Policy Stimulus

Key to the expectation that the economy can bounce back strongly over the next two years is the massive amount of government economic policy stimulus flowing through the economy.

The Federal Budget has reinforced the government’s commitment to a strong private sector-led recovery. The focus was on boosting business investment to generate jobs over the next three years. The trick for the government is to wind down the emergency policies such as Jobkeeper without damaging the economic recovery. The budget contains a raft of measures to assist in that transition and lay the foundations of a sustainable private sector recovery over the years ahead (see Judo Budget Report).

Various state governments have updated their budgets in the past month revealing not only the extent of the hit to government finances but also some interesting and important initiatives to help get the economy going again. So far State Government finances have fared better than the Fed’s but we are still seeing some big fiscal hits to the bottom line. In a world of low interest rates, we shouldn’t be too worried about a short-term budget blow out.

Every arm of government is supporting the recovery

The focus is reviving the economy and most of the states are implementing important initiatives to support the federal government’s efforts to ensure a recovery grabs hold in 2021. State governments are boosting infrastructure investment and providing on-going tax relief to local businesses. In a policy adapted from a UK measure, the NSW government has introduced $100 worth of vouchers for each adult to spend on hospitality and entertainment activities.

The RBA also joined the stimulus party after hibernating for much of the winter. A cut in key short-term interest rates to new near zero record lows was just part of the story. The RBA has gone ‘all in’ now by launching a quantitative easing program (see page 3). QE has been around in Japan for 20 years and in the US and Europe since the GFC. The objective is to lower long-term interest rates and put downward pressure on the $A. A lower $A will make Australia’s exports cheaper in international markets and should help domestic producers compete with imported product. The hope is that this will give Aussie businesses a competitive boost.

The international outlook brightens

Global equity markets have surged to record or near record highs. Big listed public corporations around the world appear to have managed through the pandemic in reasonable shape. The worst fears of a collapse in economic activity, earnings and profitability have proved unfounded. Sure, earnings and profits have taken a hit, but investors are confident this will prove temporary.

Boosting asset prices is also an important way that QE policies impact the economy. By driving down long-term interest rates QE makes investing in bonds less attractive and ‘pushes’ investors into higher risk, higher return assets like equities. Lower interest rates also improve equity valuations through a lower discount rate. This helps all assets not just equities and can also explain why property markets have performed well in recent months.

The Chinese economy, now a major engine of world economic growth, is recovering strongly from the initial coronavirus slump. The unique ability of the Chinese government to squash the virus and ignite economic activity has been extraordinary. Great news for China and good news for the rest of us. China’s economy is on track for 2% growth in 2020 with some estimates for 2021 as high as 8% growth. This would be the equivalent of adding an economy just a little smaller than Australia’s in a single year.

This strong growth will drive rising demand for everything from metal to food. As noted on page 2, Australia does face some unique challenges in our relationship with China but so far these should be viewed as a headwind to our recovery rather than a major setback.

Positive signs are emerging from the global economy

The US election has seen a palpable lift in the global political mood. Whatever you think of Donald Trump, his approach was aggressive and somewhat divisive. Trump was pushing hard down an America first track and providing a loud voice for protectionism and antiglobalisation. This is a big turnaround for the US government. For the last 75 years the US has been leading efforts to drive a free and open international trading system.

Trump gave credence to politicians wanting to put up barriers to trade in response to domestic economic weakness. While we should not expect a complete reversal from President elect Biden, there is every likelihood he will forge a more moderate course and bring America back from hard line protectionism.

Some believe he will move quickly to join the Trans Pacific Partnership (TPP) trade pact which Trump pulled out of almost immediately upon becoming President. A reinvigorated TPP will open up opportunities for businesses across the economies of the Asia-Pacific and reinforce the Asian Region as the new centre of global economic growth.

Even without a US lead TPP in place, 15 countries in Asia signed the largest trade pact in history in November. The Regional Comprehensive Economic Partnership (RCEP) has been in negotiation since 2012 and covers about one third of the global economy worth more than $US25 trillion in GDP each year. This is larger than the Canada-USA-Mexico deal (covering $24trn in GDP) and bigger than the European Economic Area ($19trn). The RCEP is in its early stages and will need to develop further to become a genuine free trade deal but it is a great signal to the world that Asia is open for business. This pandemic has fast tracked the Asian century and Australia and New Zealand are in a great place to benefit from the world’s largest and fastest growing economic region.

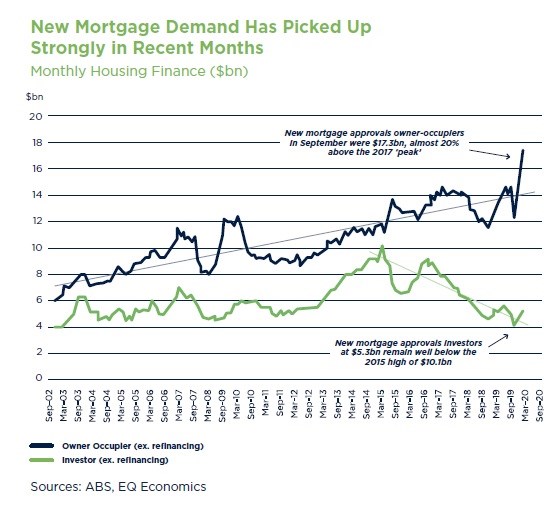

Property Markets are turning around

Residential property prices are now rising across the country with both owner occupiers and investors taking out more new mortgages since the middle of the year. According to Corelogic data house prices rose across every major capital city in October. The only exception was Melbourne, where the market is only just emerging from stage four lockdown.

This follows five months of price declines since the onset of the pandemic. Lower interest rates, good health outcomes and strong jobs growth are all factors supporting the housing market. Critically, that special ingredient, confidence, has returned and Australians are once again showing strong interest in the property market following a pandemic induced hiatus.

House prices across Australia are above where they were a year ago. Overall Australian house prices are 3.9% up on the level from October 2019 with Sydney up 6.1%. Melbourne is lagging the upswing with annual price growth of just 0.7%. Continued good health and employment outcomes could see Melbourne catch-up very quickly with the rest of the country.

The housing recovery is being led by people buying a house to live in, that is owneroccupiers. Owner Occupiers are made up of first home buyers and up-graders. Both segments are rising strongly. In September, the value of new mortgage approvals for owner-occupiers hit a new record high of $17.1bn. This is a 41% increase in just four months and is 52% above the value of new mortgage approvals in May 2019 (the cycle low point).

Residential property investors have been cautious for several years with the pandemic only adding to nervousness in that part of the market. There is some evidence that investor activity may also be turning around with investor mortgage approvals rising 30% in the four months since May.

A key barometer of economic health is on the up

A strong property market is an important indicator of broader economic health. Rising prices boost confidence and spending power within the household sector more generally. More importantly, rising house prices tend to lead to a pickup in construction activity which generates jobs in a range of industries from manufacturing through to tradies.

We are not out of the woods yet!

The global new case count is surging with the critically important economies of the US and Europe being hit hardest. Although we have had great news on the vaccine front, we still have an active pandemic which is causing havoc in the northern hemisphere. The reality is the vaccine is months away.

Complacency is the enemy in this battle and unfortunately the retreat of COVID-19 over the northern summer appears to have set Europe and America up for a horrendous second wave. New cases, hospitalisations and deaths are approaching the highs from earlier in the year. The second wave in the Spanish Flu pandemic a century ago was the most damaging. Let’s hope that is not the case again.

The economic impacts are not expected to be any near as severe as in the first wave. Partly that is because the restrictions are less onerous (so far) and partly because there is less fear associated with this wave. This is a genuine risk to the global recovery in the short-term and very sad given the prospect of a vaccine is in the offering in the not too distant future.

China’s economic recovery has been surprisingly strong, but Australia is being targeted by the Chinese government in a trade skirmish. While the big mineral commodity exports have been left alone so far, the Chinese government is making life particularly difficult for exporters in certain sectors with various trade inhibiting actions costing businesses millions of dollars in lost revenues. Those businesses operating in China need to stay close to their local contacts and try and keep the flow of product going. At the same time, they should be thinking about alternative markets as this trade skirmish is part of a broader global trade dispute that may not end any time soon.

Confidence is building in our economic recovery, but confidence can be fragile, particularly in the early stages of recovery. A deterioration in the health situation or a slump in equity markets could be enough to unsettle consumers.

The big issue is employment. Although wages and available hours of work are weaker than in a normal economic environment, people appear to be looking through this short-term weakness, focused instead on the benefits of having a job. Outside of Victoria, Australia’s employment level is only 1% below where it was prior to the pandemic even though hours worked remains 3.8% below the pre-COVID levels.

Australia still has to navigate the end of the JobKeeper program without losing economic momentum. The risk is a loss of jobs once the subsidy is removed.

Ending the JobKeeper program is the biggest threat to employment in Australia over the next six months. If 10% of the people on the original JobKeeper program lose their jobs by the time the program ends in March next year, this will amount to approximately 350,000 job losses.

Disclaimer

This document has been prepared by Judo Bank Pty Ltd ABN 11 615 995 581 AFSL 501091 (“Judo Bank”). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, Judo Bank recommends that you consider whether the advice is appropriate for your circumstances.

So far as laws and regulatory requirements permit, Judo Bank, its related companies, associated entities and any officer, employee, agent, adviser or contractor thereof (the “Judo Bank Group”) does not warrant or represent that the information, recommendations, opinions or conclusions contained in this document (“Information”) is accurate, reliable, complete or current. The Information is indicative and prepared for information purposes only and does not purport to contain all matters relevant to any particular investment or financial instrument. The Information is not intended to be relied upon and in all cases anyone proposing to use the Information should independently verify and check its accuracy, completeness, reliability and suitability and obtain appropriate professional advice. The Information is not intended to create any legal or fiduciary relationship and nothing contained in this document will be considered an invitation to engage in business, a recommendation, guidance, invitation, inducement, proposal, advice or solicitation to provide investment, financial or banking services or an invitation to engage in business or invest, buy, sell or deal in any securities or other financial instruments.

The Information is subject to change without notice, but the Judo Bank Group shall not be under any duty to update or correct it. All statements as to future matters are not guaranteed to be accurate and any statements as to past performance do not represent future performance.

Subject to any terms implied by law and which cannot be excluded, the Judo Bank Group shall not be liable for any errors, omissions, defects or misrepresentations in the Information (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the Information. If any law prohibits the exclusion of such liability, the Judo Bank Group limits its liability to the re-supply of the Information, provided that such limitation is permitted by law and is fair and reasonable.

This document is intended only for clients of the Judo Bank Group, and brokers who refer customers to the Judo Bank Group, and may not be reproduced or distributed without the consent of Judo Bank.

The Information is governed by, and is to be construed in accordance with, the laws in force in the State of Victoria, Australia.